Are ETRM/CTRMs Supporting Trading Needs in 2024?

Summary: ETRM/CTRM Transformation + Modernization in 2024

Modernizing risk operations is no longer a “nice to have” — it’s essential for staying competitive in shifting markets.

As companies prioritize modernization, the focus is shifting toward streamlined software solutions offering enhanced speed, usability, and direct data access. The results of our first-ever ETRM/CTRM Transformation + Modernization survey highlight the evolving expectations of today's trading organizations and the demand for more agile, robust, and reliable systems.

We’re going to dive into the biggest takeaways from the survey, plus you can also access the full 2024 ETRM/CTRM Transformation + Modernization report for a comprehensive analysis and exclusive commentary from experts across the energy and commodities industries.

Table of Contents

- This year’s theme: speed up to keep up

- Survey methodology

- Key findings: modernization in 2024

- Top priorities for risk managers

- Challenges to modernization

- Are ETRM/CTRMs supporting trading needs in 2024?

- Resources

This year’s theme: speed up to keep up

It’s a volatile market out there.

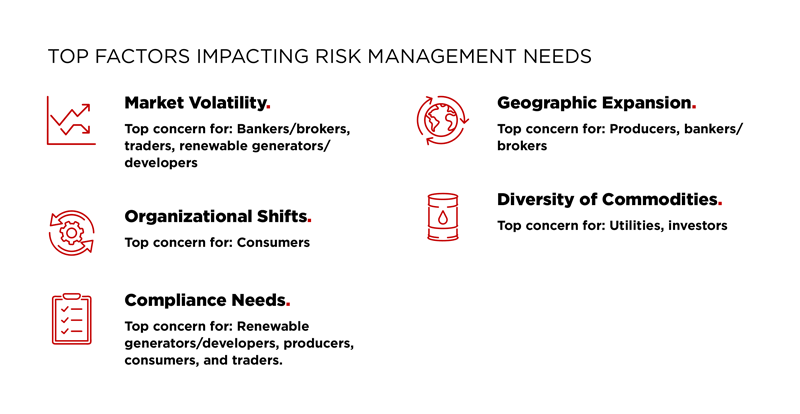

Trading organizations are feeling the push to update their operations as a result of evolving behaviors and policies. Factors like supply chain instability, technological advancements (like the AI surge), and the global energy transition underscore the necessity of adapting — swiftly — to survive in a dynamic market.

“When you think about risk, there’s realized volatility which can be measured and seen, and then there’s unrealized volatility, which is really the unknown in which most organizations, from a risk perspective, you try to manage.” – Jeff Davies, Founder, EnerWrap

And there’s no sign of slowing down. As a result, agility and analytics are top of mind for many trading organizations, and will continue to play a key role in managing risk operations.

Companies are increasingly driven to modernize not just to gain a competitive edge but also to tackle real challenges that their current systems may struggle with—such as managing new instruments or large amounts of data or getting more accurate reports faster. This is where automated, cloud-native, multi-tenant software solutions will shine, helping to solve problems and save time while improving risk operations.

The markets are changing, and so are the expectations for what a modern ETRM/CTRM platform should be. There’s a significant opportunity for modern ETRM/CTRMs to align with companies’ changing needs and objectives to support key operations for today, tomorrow, and the years ahead.

“While market volatility is important, it’s really that organizational shift column is the tail that I feel wags the dog. As organizations focus more and more on sustainability, we see this move to more complicated power contracts, higher quantities of them, and really needing to build that into — and this speaks to the diversity of the commodities… the ability to capture those transactions into the system.

“And then on the flip side of things, as we think about data centers out there, the AI movement, the computational needs and the amount of data centers out there is making the world power hungry, which starts a whole new level of types of transactions out there. So those two things are really, what I’m seeing, drive the energy transition at this point in time.” – Michael Barrett, Managing Partner, EY

Survey methodology

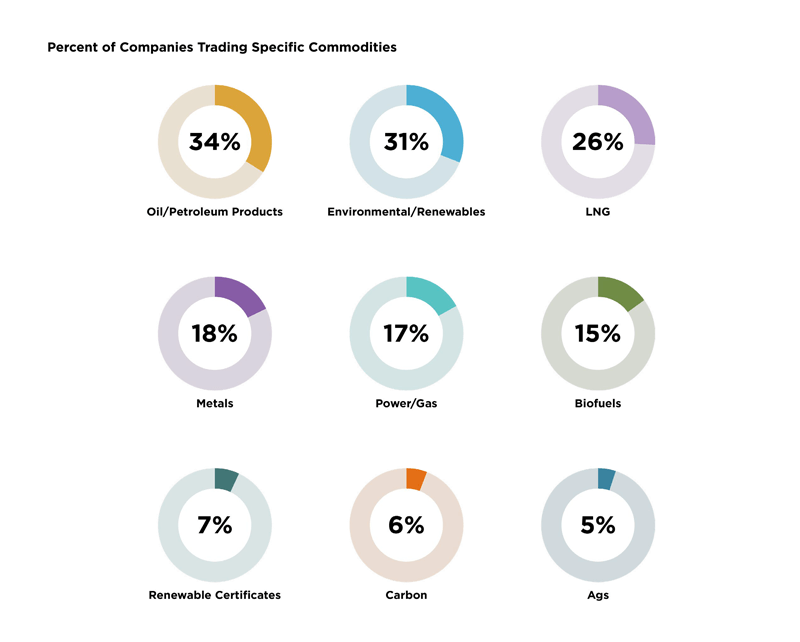

Over 200 participants in the commodity market responded to our survey. Respondents represented small (under $1 million), mid-size, and large organizations (>$1B). The data gathered represents companies that trade all types of instruments, ranging from oil/petroleum products, power and gas, LNG, biofuels, metals, environmental/renewables, and more.

Key findings: modernization in 2024

Here are the biggest takeaways from our 2024 ETRM/CTRM Transformation + Modernization Report.

- 90% of all respondents report planning a modernization initiative or having one currently underway

- Modernization is a top priority across all company types and sizes

- 100% of bankers/brokers and renewable developers are planning to modernize

- 75% of all other company types have modernization plans

- Renewables developers, consumers, and advisory firms are the furthest along: nearly 40% have modernization initiatives currently in progress.

- Nearly 100% of companies with $500 million to $1 billion have a modernization initiative underway, while 60% of smaller companies (under $1M) are planning one

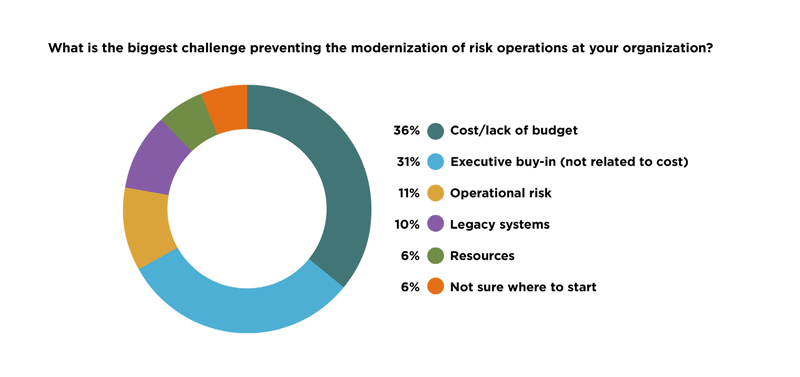

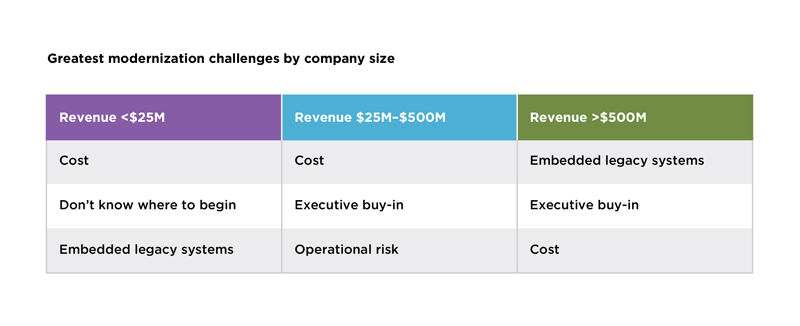

- Despite the need to modernize, cost and executive buy-in are the greatest challenges to modernization

- 21% of the smallest companies don’t know where to begin when it comes to modernization

Top priorities for risk managers

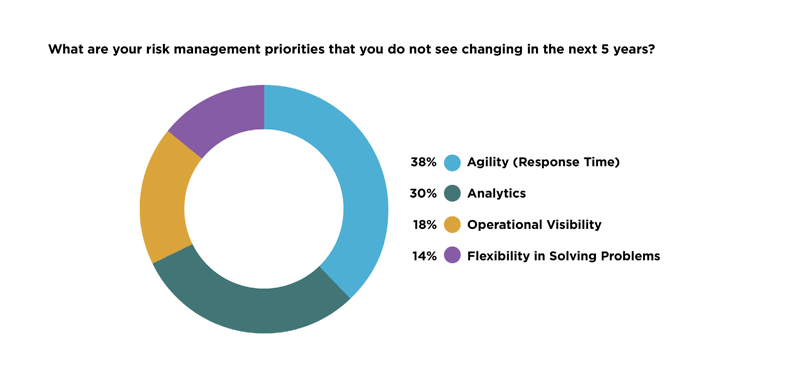

When asked about which risk management priorities will not change over the next 5 years, the response was overwhelming: nearly 70% of all responses stated agility and analytics.

It makes sense: both agility and analytics are fueled by the need for speed. Today’s trading operations demand agile, automated solutions to navigate evolving business processes effectively, ensuring faster decisions and more accurate risk assessment.

The commodities market is moving towards algorithmic or automated trading — so, speedier trades need more agile systems. Automated trades happen in seconds, so reporting needs to be just as fast. Plus, with tech advancements like AI and real-time data, quick analysis of trade data and report creation that takes seconds, instead of hours, are a must.

In short: in the traditionally slow-moving energy industry, companies are now realizing that modernization is no longer a shiny upgrade option… it’s essential for their survival.

Challenges to modernization

While there's a lot of confidence in kicking off modernization efforts, cost and executive buy-in are the biggest modernization challenges across all respondents.

From smaller teams with less institutional knowledge, to enterprises with embedded legacy systems, these challenges are being felt across organizations.

Are ETRM/CTRMs supporting trading needs in 2024?

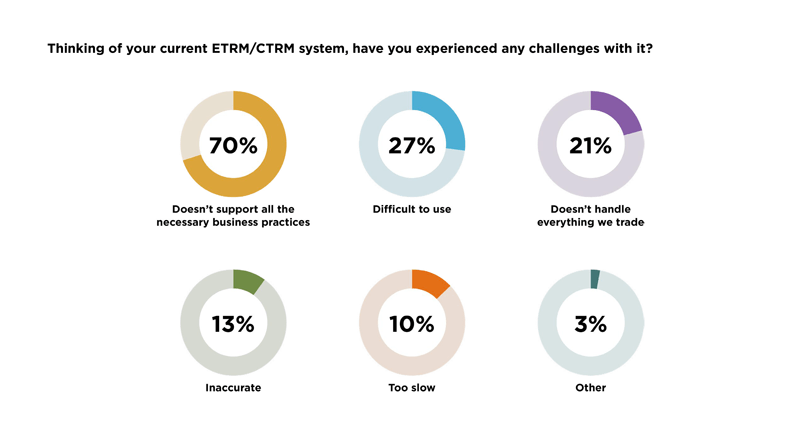

80% of users feel their current system doesn’t support all their necessary business practices or is too slow, and a further 21% say it doesn’t handle everything they trade. This signifies the need for more adaptable and scalable solutions to keep up with their evolving trading needs.

Our findings were consistent across all company types, with consumer companies showing a strong bias at 45%. Traders and advisory firms, particularly, faced challenges with existing systems, impacting daily operations and market entries. Traders highlighted the system's slow performance, with 57% reporting difficulties.

Renewable credit and offset management are increasing needs for ETRM/CTRM systems. 35% of renewable generators/developers lack full trade support, highlighting the demand for ETRM/CTRM systems to evolve with changing markets/commodities.

“Moving forward, ETRM solutions will need to be ever more scalable and extensible as renewable energy and battery storage continue to drive complexity in both generation mix and the contractual structures to which modern energy portfolios are exposed. SaaS-based solutions that leverage cloud infrastructure will have a competitive advantage, ensuring software delivery is high performance, modular, and flexible enough to keep pace with the Energy Transition.” –Mark Bosse, VP of Business Development and Marketing, cQuant.io

Legacy ETRM/CTRM systems are too slow

Outdated ETRM/CTRM systems can be sluggish, taking hours to generate risk reports on positions and exposure. Frankly, that’s not good enough in today's fast-paced environment. Now, data is almost immediately accessible, and analytics can be run in seconds.

Efficiency is at the core of the desire for a modern ETRM/CTRM system, prompting a demand for streamlined data input, real-time analytics, and user-friendly interfaces for precise price risk assessment. Automated systems with a unified record system ensure speed and reliability, enabling quick data access and analytics within minutes.

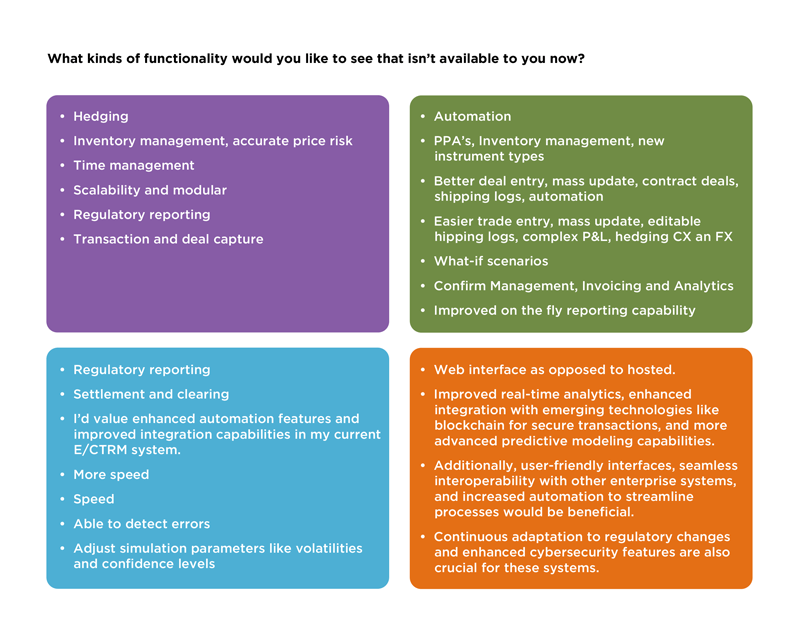

Most desired features in an E/CTRM

In an open-ended question, we asked survey participants to tell us what functionality they would like to see (in an ETRM/CTRM) that isn’t available to them now.

There’s a clear underlying theme for desired functionalities: namely, speed and automation, user-friendliness, deal entry, integrations, and the ability to handle various instrument types. This highlights speed and agility as top priorities while also underscoring the finding that many ETRM/CTRM systems in use today fail to support all the business practices organizations need to thrive.