How ETRM Systems Handle Renewable Certificate Management

Key Takeaways

- A modern ETRM centralizes renewable certificate tracking across the full lifecycle: from projected to minted, delivered, and retired.

- Risk management features help prevent over/under buying, double-counting, and position mismatches.

- Automated updates to position and inventory data minimize manual errors and keep compliance reporting audit-ready.

Managing Renewable Certificates Is Complex. An ETRM Makes It Simple

Renewable energy is reshaping the global power market. That’s great for environmental and energy transition goals, but it presents a growing challenge for energy trading companies: managing renewable energy certificates and related instruments efficiently and profitably.

Certificates are complex. They’re tied to registries and trading platforms, jurisdictions, and constantly changing compliance requirements. But sellers need to optimize the value of their certificates; buyers need to meet obligations as efficiently as possible.

The biggest challenges companies struggle with include:

- Tracking inventory, obligations, and certificate attributes across multiple systems — risking certificates expiring or aging out.

- Preventing errors like double-counting or misaligned positions that can result in overpaying or undercharging, missing opportunities to optimize trades and pricing.

- Supporting compliance with automated, auditable reporting.

- Allocating inventory to obligations — often a manual, ad hoc process that’s focused on delivery only. As portfolios grow, so does the risk of missed savings and internal bottlenecks.

In many situations, the technology available to manage renewable certificate portfolios hasn’t evolved as quickly as the markets – adding a layer of difficulty to an already difficult task.

Table of Contents

- Understanding the Lifecycle of Renewable Certificates

- How ETRM Systems Capture Renewable Certificate Data

- Managing Renewable Certificate Risk

- Ensuring Accurate Renewable Certificate Position and Inventory Tracking

- Handling Minted and Delivered Renewable Certificates in an ETRM

- How an ETRM Simplifies Renewable Portfolio Reporting

- Effective Renewable Certificate Management Requires a Modern ETRM

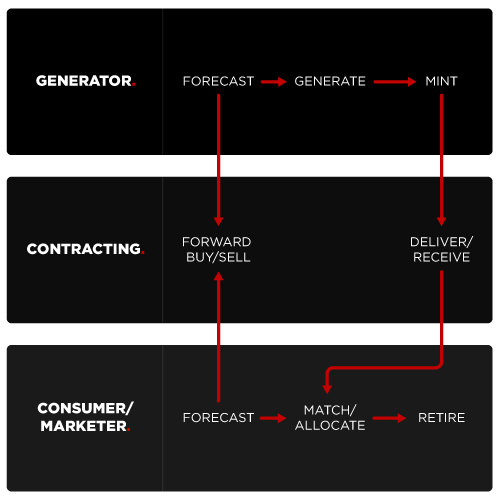

Understanding the Lifecycle of Renewable Certificates

The renewable certificates lifecycle is complicated by accounting for two different, but interconnected, commodities: renewable energy generated and renewable energy certificates. From forecast to retirement, accurate tracking is critical — not just for reporting, but for compliance, auditability, and optimizing commercial outcomes.

Lifecycle Steps

Here’s what the lifecycle typically looks like for renewable certificates:

- Estimate generation volumes and compliance obligations for electricity-based certificates, such as RECs or GOs

- Secure forward contracts — agree to buy or sell certificates before they’re minted, based on projected supply/demand

- Record certificates as they’re minted from registries or aggregators, capturing attributes like serial number, vintage, and project details

- Allocate delivered certificates to trades and obligations — assign certificates to meet compliance requirements or settle contractual deliveries

- Track inventory in near real-time — monitor current holdings by type, vintage, status, and ownership — at bulk or serial level

- Retire certificates for compliance closure or sales finalization

- Generate audit-ready reports — ensure jurisdictional, compliance, and vintage requirements are met and documented

Each stage of the lifecycle builds on the last, and any gaps or errors can lead to costly mismatches, compliance failures, or lost revenue.

How ETRM Systems Capture Renewable Certificate Data

Accurate data is essential for effective renewable certificate management. A renewables-ready ETRM software captures data through integrations with registries, aggregators, and market data providers — as well as via APIs, data upload tools, or simple manual entry. The key is to have a dedicated place for renewable data, such as vintage, location, serial numbers, and class data fields.

Here’s what you should expect from a modern ETRM that can handle renewables:

- Integrations with registries, aggregators, and market data providers to automate data ingestion, as well as the ability to upload trades in bulk or make connections via API

- Manual entry with validation tools to catch errors before they happen

- Custom tagging and serial tracking to group and manage certificates accuratelyA renewable-ready ETRM supports granular tracking and lifecycle management of renewable certificates, including serial-level detail, automated data matching, and project-based attribution to ensure every certificate’s lifecycle is fully documented and reconciled. By centralizing all renewable certificate data in one place, the right ETRM software ensures you always have a complete, auditable position view.

Managing Renewable Certificate Risk

Tracking renewables isn’t just about inventory — it’s also about risk exposure. Renewable certificate risk management depends on accurate policies for buying and selling certificates based on production or usage. Without a structured, automated approach, risk managers waste time reconciling mismatched data — or worse, make costly trading errors.

A modern ETRM mitigates these risks by:

- Tracking obligations against real-time inventory

- Excluding retired certificates from active positions to prevent double-counting

- Reconciling positions using forecasts, forward trades, and actual deliveries

With a clear view of renewable certificate status — projected, minted, delivered, retired — you can manage certificate risks with confidence.

Ensuring Accurate Renewable Certificate Position and Inventory Tracking

Since renewable certificate positions change throughout their lifecycle, a renewables-ready ETRM supports the accuracy and reliability of your position and inventory data through its audit trails, automated data loads, and matching capabilities. It reduces the risk of position mismatches and helps keep your renewable inventory accurate.

It provides audit trails for every certificate movement, from projected to minted, delivered, and retired, for RECs, RINs, RGGIs, and LCFS credits. Automated updates as certificates are traded or used to minimize spreadsheet errors, so you gain significant protections compared to spreadsheet tracking. Certificates can be matched with their associated commodities to categorize them for reporting.

With a modern ETRM, you can match renewable certificates to their associated trade(s) and commodities, keeping track of certificates in high-volume or bundled contracts along with their outlooks and exposures. Custom tagging and serial number tracking enable bulk and granular certificate tracking within these contracts.

Handling Minted and Delivered Renewable Certificates in an ETRM

Once certificates are minted, they must be properly accounted for and tracked within the system. An ETRM built for renewable certificate management connects to registries and aggregators to bring in structured certificate data – automating lifecycle tracking from creation to retirement.

- Minted certificates are downloaded from registries and recorded as inventory

- Delivered certificates are linked to trade volumes or obligations, ensuring accurate lifecycle tracking

- Status updates flow through the system, keeping compliance reports audit-ready

- Transfer and retirement instructions can be generated for registries

Molecule models all key certificate attributes, resulting in complete and accurate valuations throughout the lifecycle. It tracks certificates as physically delivered inventory (both in bulk and at the serial number level), which can then be matched against obligations to optimize the value of your portfolio and give accurate current and forward position reports.

The result is accurate and up-to-date inventory data for analytics, reporting, and auditing.

How an ETRM Simplifies Renewable Portfolio Reporting

Regulatory and compliance reporting for renewables is complex and time-sensitive. A renewable-ready ETRM reduces manual work by automating position and inventory reports so you always know your exact holdings. It offers custom API exports and integrates with BI tools, GLs, and ERPs.

Specialized reporting built for renewable certificates provides insight into positions, inventory, obligations, vintage, and REC status – keeping you ahead of compliance deadlines without last-minute data scrambles.

Effective Renewable Certificate Management Requires a Modern ETRM

With the growing variety of renewable certificates — each with distinct vintages, compliance rules, and market dynamics — companies trading renewable energy need an ETRM that can reliably track them through their entire lifecycle with audit trails for every movement, including trading, forecasting, minting, allocating, retirement, and reporting.

Without an ETRM built for renewables, companies can easily lose track of what certificate they are holding, which have been allocated, and what certificates they need to purchase to stay compliant, leading to position mismatches, over- and under-buying, and lower profits.

Managing renewable certificates is complex, but a renewable-ready ETRM provides clarity with reliable, auditable tracking and reporting — giving you the confidence to stay compliant, fulfill obligations, and keep your business moving forward in an increasingly complex market.

Editor’s note: This blog was originally published in January 2024 as "How Do ETRM Systems Handle Renewable Credit Management?". It was extensively updated and republished in July 2025.