How Much Does ETRM Software Cost in 2026?

A look at how much an ETRM costs, what affects the price, and how Molecule compares to other energy trading risk management software.

How PPA Complexity Is Reshaping Power Trading

What’s really driving PPA complexity today: the contract, the market, or the system behind it? As renewables scale, the answer matters more than ever.

Zonal vs Nodal Power Markets: How Market Design Shapes Trading Outcomes Globally

From zonal to nodal pricing, see how the world’s power markets are rewriting the rules of risk, visibility, and profitability.

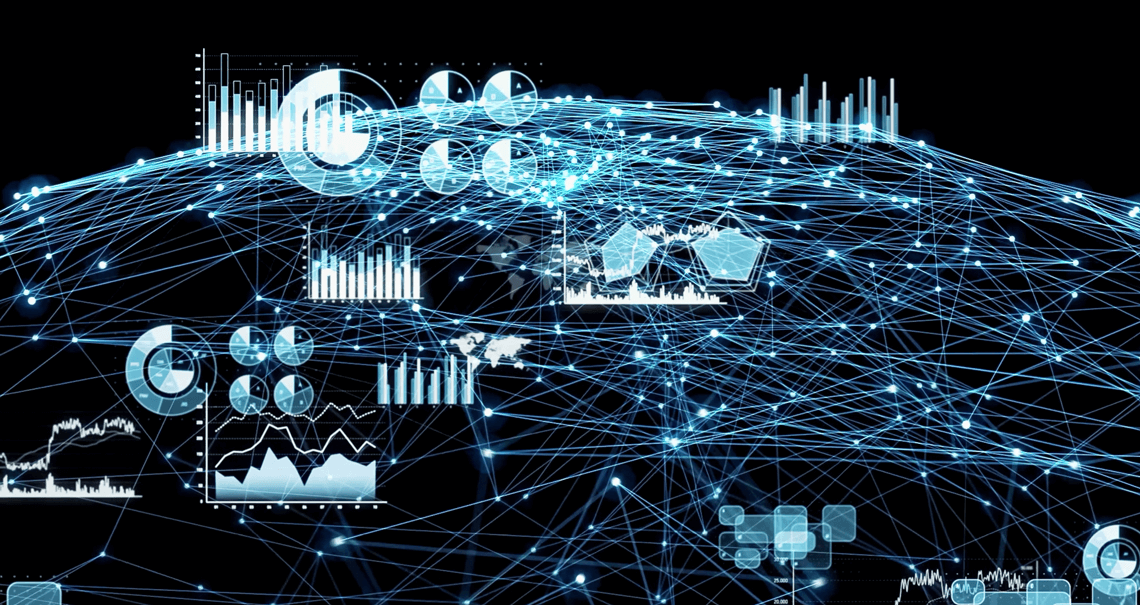

Energy & Commodities Trading in 2025: What 400+ Respondents Told Us About ETRM/CTRM Modernization

This year’s report, built from over 400 responses across 10+ industries, shows how far the market has come… and where it’s still stuck.

How Does ETRM Software Support Power Trading? Use Cases + What to Look For

If you’re managing a growing power portfolio, you need a system that keeps up — one that tracks exposures as they shift, reflects risk in real time, and gives you the data you need to act with confidence.

Big News: Molecule Closes Series B Funding

We are both proud and ecstatic to share we completed our Series B funding round — an important step as we

How ETRM Systems Handle Renewable Certificate Management

RECs, offsets, and obligations add complexity fast. The right ETRM helps you stay accurate, audit-ready, and in control.

How Interoperability Improves Decision-Making in Energy Trading

When systems talk to each other, decisions come easier. And that’s exactly what modern energy traders need to stay ahead.

How Future-Ready ETRMs Power Renewable Trading

The renewable energy trading market isn’t slowing down… so neither should you. Here’s how you can stay ahead in a market that keeps changing.

Using Spreadsheets to Handle Your Complex Power Portfolios? Here’s Why It’s Holding You Back

When datasets are large and complex, and one mistake can cost millions... why risk it?