How Do ETRM Systems Handle Renewable Credit Management?

The renewables market will continue to grow at an explosive rate, with renewables on track "to provide more than one-third of total electricity generation globally by early 2025, overtaking coal," (according to the IEA’s Electricity Report).

If you’re trading renewable commodities and certificates, you understand the evolving requirements and complexities they bring – and you’re probably well aware that not every ETRM is equipped to track and handle the demands of credits and offsets.

In this post, we'll give you a breakdown of how an ETRM (energy trading risk management) system like Molecule handles renewable credits, like RECs and RINs, and we’ll focus on the innovative features available to adapt to current and future renewable markets.

We'll answer all of your burning questions and explore:

- How do ETRM systems capture renewable credit data?

- How can an ETRM system help to manage risks related to renewable credits?

- How can an ETRM ensure consistent and accurate renewable position/inventory?

- How can an ETRM solution handle minted and delivered renewable credits?

- How can an ETRM system streamline reporting for renewable portfolios?

How do ETRM systems capture renewable credit data?

ETRM software can capture renewable data through built-in integrations, data upload tools, or simple manual entry. The key requirement is to have a dedicated place for renewable data - such as vintage, location, serial numbers, and class data fields.

An ETRM with automated processes for renewable data imports can significantly save time and reduce errors. For example, through:

- Built-in integrations to ISOs and registries that enable data to flow directly into the system – automatically and error-free

- Structured file uploads or API endpoints that allow fast and accurate loading of bilateral transactions and updates that may not go through any external platform.

With your renewable data in one platform, you have more visibility and control over your renewable portfolio.

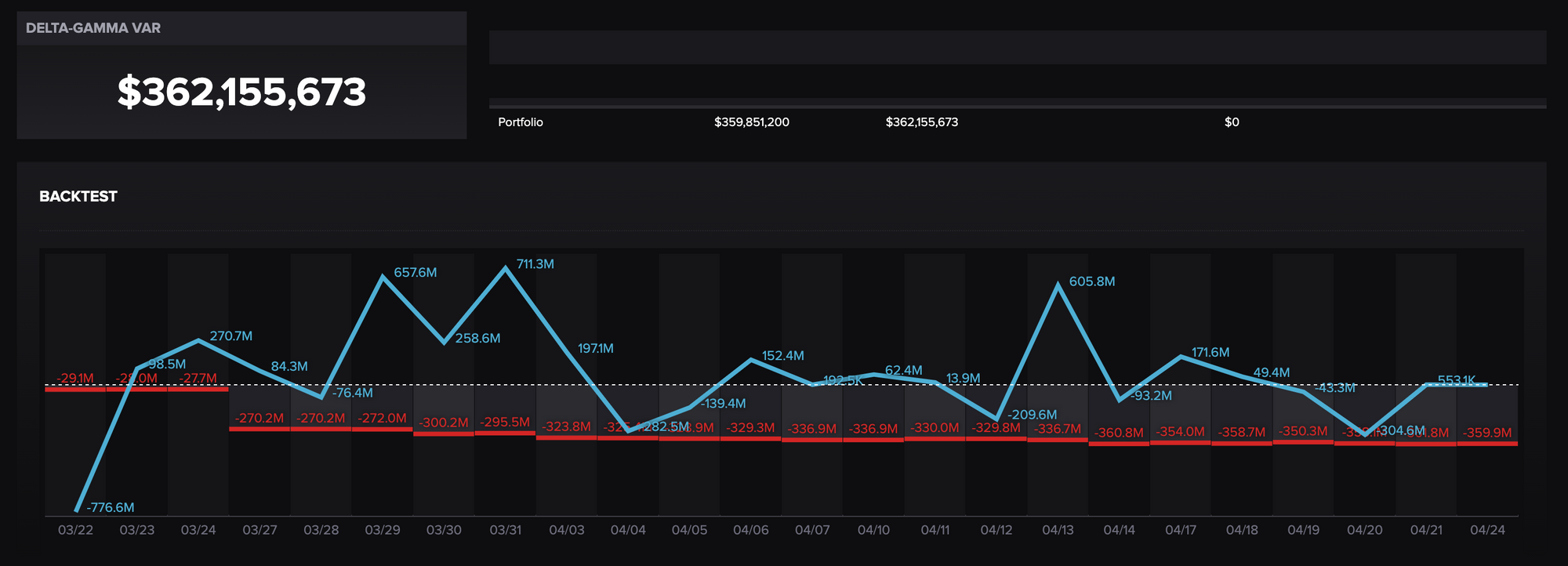

How can an ETRM system help to manage risks related to renewable credits?

A renewable-aware ETRM allows you to capture and track essential renewable credit data to manage risks, such as risk policy compliance and over/under buying or selling. With an ETRM, you can keep track of the entire lifecycle of renewable certificates – from projections to minting, purchase/sale, and retirement.

Risk management for renewables is typically based on policies for how many credits or offsets should be bought and sold by your business, depending on production or usage.

ETRMs are great at this type of risk management because they are built for tracking position. With renewables, the position depends on status, such as projected, minted, bought/sold, delivered, and retired. If you are tracking your status accurately, then you will have reliable inventory positions to monitor and apply your policies on position levels and limits. For example, you avoid the risk of double counting (aka double claims) by tracking and excluding retired certificates from your inventory.

With both business data and renewable position stored in your ETRM, you’ll be able to see a combined picture that gives insight into risk position. You'll be able to match up the credits in your inventory against your energy or commodities trades to see purchases or sales you need to make and risk policy gaps.

How can an ETRM ensure consistent and accurate renewable position/inventory?

You can ensure the accuracy and reliability of your position and inventory data through an ETRM’s audit trails, automated data loads, and matching capabilities. You gain significant protections compared to spreadsheet tracking, and a single location for all your data.

With a renewable-aware ETRM, you can match renewable credits to their associated trade(s) and commodities to keep track of certificates in high-volume or bundled contracts along with their outlooks and exposures.

Molecule’s ETRM, for example, uses our inventory module for minted and delivered RECs, RINs, RGGIs, and LCFS credits. You can link a delivery (“ticket”) to the relevant purchase or sale contract (“trade”) in your portfolio.

For bundled credits, you can use the serial number field to group credits. With Molecule’s serial numbers, you can group thousands of credits together if you purchased them in bulk.

Moreover, you can match your credits with their associated commodity to categorize the credits produced for reporting. With custom reports, Molecule can compare certificates with the commodities that generated or consumed them.

How can an ETRM solution handle minted and delivered renewable credits?

An ETRM adapted for renewable credit management will handle minted credits by connecting directly with registries or aggregated providers or by manually allowing users to mint credits through the applications' interface.

For instance, you would model minted or delivered certificates in Molecule through a ticket, which will increase or decrease inventory levels. You can even indicate and update the delivery status of your certificates for enhanced visibility.

These status changes to certificates enter the system through tickets, which deliver and actualize trade volumes. The result is audit-ready, accurate, and up-to-date REC inventory data for analytics and reporting.

How can an ETRM system streamline reporting for renewable portfolios?

Modern ETRMs offer unique reporting capabilities, such as forward positions and APIs. You can gain deeper insights into your portfolio with built-in or custom ETRM reports that you can configure and extract for further analysis.

Since ETRMs optimize position, risk, and exposure reporting, you can get automated, up-to-date risk valuations and reports. ETRMs also enable custom reporting features to meet your unique business requirements and give you insight into:

- Positions

- Inventory

- Obligations

- Vintage

- REC status

In addition to near real-time reports, look for ETRMs that use modern, flexible APIs to efficiently get your reporting data out of the system. With Molecule, for instance, you can:

- Easily extract your reports into a JSON or CSV file

- Automatically load reporting data into Excel

- Connect directly to a BI tool, GL, or ERP

Investing in a renewable-aware ETRM is table stakes for efficient, insightful, and risk-controlled participation in the energy transition economy.

Look for an ETRM platform that optimizes data integrations, accommodates all the required tracking data, and seamlessly keeps inventory current through all the lifecycle status changes. While spreadsheets and other solutions may quickly grow unwieldy or unmanageable, an ETRM keeps you organized and on top of all the data in your portfolio.

Updated December 2024