Using Spreadsheets to Handle Your Complex Power Portfolios? Here’s Why It’s Holding You Back

Key Takeaways

- Managing a power portfolio requires dealing with large, complex datasets — not ideal for spreadsheets.

- Manual data entry, version control, and reporting delays make spreadsheets a risky choice for managing energy trading and risk.

- A future-ready ETRM eliminates common spreadsheet limitations, delivering a single source of truth with real-time visibility.

It’s 2025, and spreadsheets just can’t keep up with the speed of today’s power markets.

Relying on spreadsheets to manage a complex power portfolio is a gamble at best. A delayed trade reconciliation, an outdated P&L, or an inaccurate position could put your business — and your bottom line — at risk. And yet, many companies still rely on spreadsheets as their system of record for power portfolios.

In this blog, we’ll break down the biggest pitfalls of relying on spreadsheets for a complex power portfolio and how modern ETRMs are built for the future of energy trading.

Table of Contents

- The Limitations of Spreadsheets in Power Trading

- Spreadsheet Mistakes Can Cost Millions

- Future-Ready ETRMs Are Built for Power Portfolio Management

- Ditch the Spreadsheets to Save Time, Cut Risk, and Increase Profit

The Limitations of Spreadsheets in Power Trading

Spreadsheets like Excel are useful when dealing with smaller datasets — but when managing a complex power portfolio, their limitations are obvious. Large datasets – such as granular forecast data and multi-decade, hourly PPAs – overwhelm spreadsheets, making them slow, error-prone, and nearly impossible to manage at scale. With hundreds, thousands, or even millions of data points to track, spreadsheets struggle to keep up with the speed and complexity of today’s power markets.

If you’re using spreadsheets to manage a complex power portfolio, you’re putting your profit margins, reliability, and reputation on the line. Here’s why:

- 94% of spreadsheets used in business decision-making contain errors. That’s not a minor issue — it poses a serious risk of financial losses and operational mistakes.

- Manual data entry is notoriously slow and inaccurate. Validating spreadsheet accuracy requires a lot of time and effort, slowing decision-making down when time may be critical.

- Energy trading data is constantly changing. The time spent manually entering and reconciling data can result in analyses and reports that are outdated before they are even published. Real-time analysis is impossible because the process is too slow.

- Spreadsheets suffer from version control. Team members can share or edit a spreadsheet without realizing that other members of the team are also editing a different version of the spreadsheet. There is no single system of record for the business, and teams may make suggestions or take actions based on contradictory information in their individual spreadsheets.

- Spreadsheets don’t have automatic compliance features, so compliance must be managed manually as well. If there are multiple versions of spreadsheets, companies must be sure compliance reporting is based on the “correct” one.

Spreadsheet Mistakes Can Cost Millions

One wrong spreadsheet formula once cost JP Morgan $6 billion. Energy risk management using spreadsheets risk similar catastrophic financial consequences resulting from mismanaged risks, incorrect settlements, and unprofitable transactions.

Spreadsheets inhibit compliance, increasing regulatory and compliance risk. They do not provide a comprehensive audit trail and lack data validation. Because of the lack of version control, data is outdated, disparate, and vulnerable to security breaches.

Data silos and the time spent manually entering and manipulating data slows the business down, making the company sluggish to act or respond. It’s not a speed that can match today’s market, so lost opportunities are common.

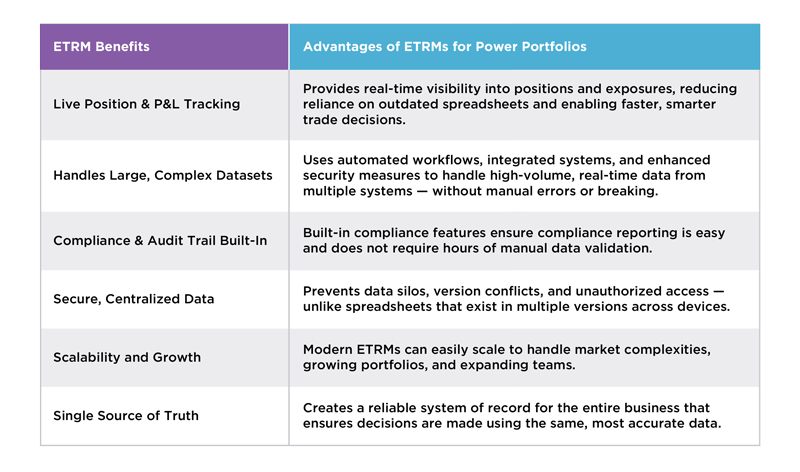

Future-Ready ETRMs Are Built for Power Portfolio Management

Spreadsheets may be cheap and user-friendly — but they weren’t built with managing high-volume, real-time power trading data in mind. Future-ready ETRMs are built with power trading capabilities in mind, so your team will spend less time fixing errors and more time making smarter, faster decisions.

Ditch the Spreadsheets to Save Time, Cut Risk, and Increase Profit

Spreadsheets are a great tool when used properly; however, they were not designed for modern energy risk management. Excel was first released in 1985 — 40 years later, spreadsheets just can’t keep up with increasingly complex power portfolios and constantly changing energy markets.

Replacing spreadsheets with a future-ready ETRM platform speeds up the entire process, improving accuracy and flexibility so companies can stay on top of the market and better manage risk. ETRMs for power portfolios help ensure regulatory compliance as well, a feature that is beyond the scope of any spreadsheet. The entire process, from deal capture to invoicing, is more secure, faster, and more accurate with a modern ETRM system.

Spreadsheets may have been enough – for a while. If you’re still using spreadsheets to manage your portfolio as your trading organization grows, though, you’re already behind — and leaving money on the table. It’s time to upgrade.