6 Powerful Ways Multi-Tenant SaaS ETRM/CTRMs Maximize Business Value

Digitalization is transforming trade and risk management software with on-prem solutions transitioning their platforms to the cloud. What’s behind this shift? Trading organizations are prioritizing modernization to meet the industry’s growing demand for more agile and scalable systems. In fact, according to our 2024 ETRM/CTRM Transformation + Modernization Report, 90% of trading companies are either planning or currently undergoing modernization efforts to enhance their trading and risk operations.

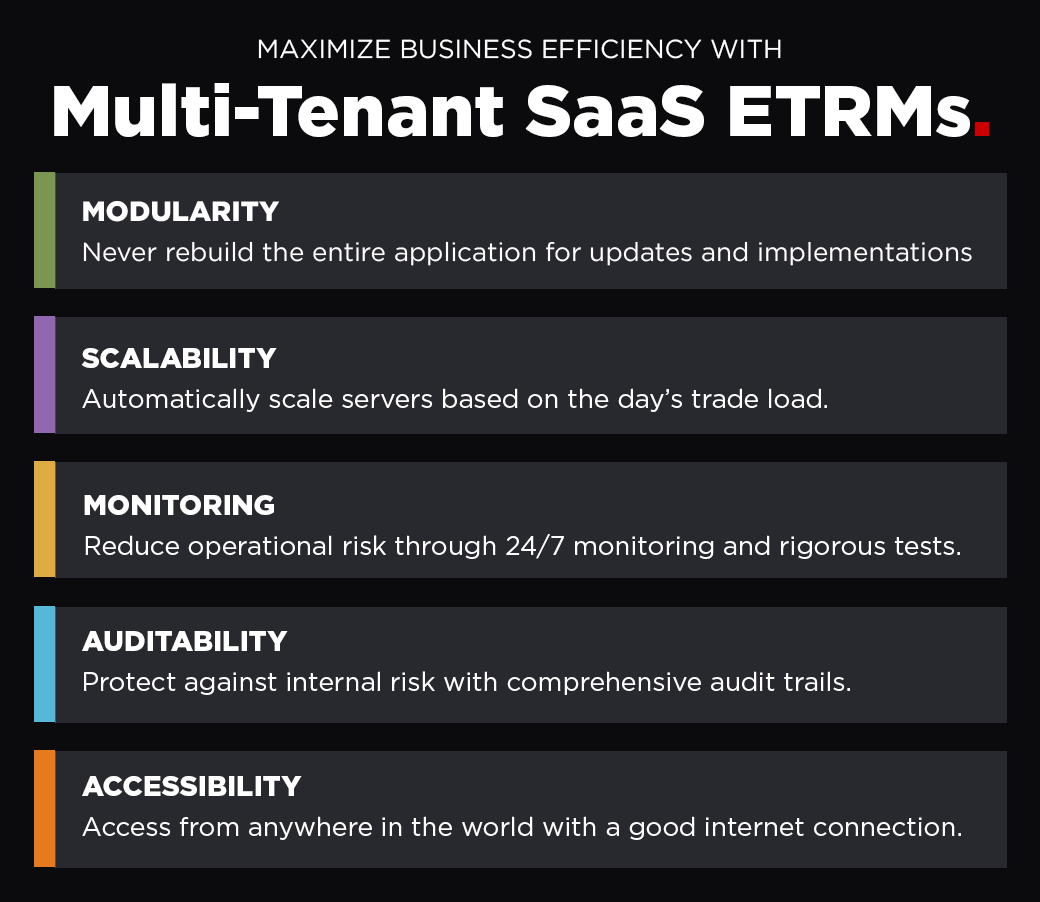

For companies using ETRMs, having a multi-tenant solution maximizes their business value by providing scalable, cost-effective solutions to enhance auditability, efficiency, accessibility, and more.

In this blog post, we’ll explore the different types of ETRM/CTRM solutions on the market and highlight the benefits of investing in a modern, cloud-native SaaS ETRM/CTRM through the following:

An Introduction to Cloud ETRM/CTRMs:

6 Benefits of Multi-Tenant, Cloud ETRM/CTRMs:

- Number One: Increased Accessibility

- Number Two: Enhanced Auditability

- Number Three: Efficient Monitoring

- Number Four: Ability to Scale Quickly

- Number Five: Adaptability and Innovation

- Number Six: Cost Efficiency

WHAT DOES IT MEAN FOR AN ETRM/CTRM TO GO CLOUD?

Before we talk about the benefits of SaaS ETRM/CTRMs, let’s first walk through the different types of ETRM/CTRMs on the market. More importantly, what it means to “go cloud” in the trade risk software industry.

Cloud software delivery models are now common – but not all “cloud” ETRMs and CTRMs are alike. "Cloud" can simply mean that server hardware is in a data center owned by Amazon, Google, or Microsoft. That’s table stakes for cloud computing. To fully benefit from cloud technology, one has to take tenancy into account.

There are two types of tenancy:

- Single-tenancy: hardware may be on shared infrastructure, but software is on a single instance that serves one company

- Multi-tenancy: hardware and software are on a shared infrastructure that serves multiple companies

Many ETRMs – even “cloud” ones – are single-tenant, meaning that each customer has their own version of the production software. This means that upgrades are slow, software code may be forked, customers completely manage their own master data, and they often pay full freight for server capacity, even though it is usually under-utilized.

Even worse, single-tenant cloud solutions often do not have the ability to scale capacity in response to heavy workloads. This means that the ETRM can get slow during end-of-day processing or other periods.

WHAT IS A MULTI-TENANT SAAS ETRM/CTRM?

Multi-tenant SaaS ETRM/CTRMs, on the other hand, share an infrastructure and codebase. Since they operate on a single application, vendors can take a modular approach to implementation by building customizations on top of the core application. In turn, some of these types of platforms can deploy quicker and at less cost.

Some multi-tenant SaaS applications, like Molecule, are also cloud-native, which means customers enjoy the benefits of the SaaS pricing model along with the full benefits of cloud technology – from upfront costs to automatic updates.

We’ll cover these benefits in more detail here and share why a SaaS ETRM/CTRM that is multi-tenant and born in the cloud may be the best option for your trading and risk management solution.

1. A MULTI-TENANT SAAS ETRM/CTRM IS MORE ACCESSIBLE.

Users of single-tenant, on-prem ETRM/CTRMs can only access software from the in-house network or a VPN. On the other hand, users of a cloud-native, multi-tenant ETRM/CTRM can access their accounts from anywhere on any device.

For example, Molecule customers can check their position, P&L, and other important reports from anywhere in the world as long as they have a good internet connection and the correct credentials.

2. MULTI-TENANT SAAS ETRM/CTRMS HAVE USER PERMISSIONS AND AUDIT TRAILS.

If you’re using a single-tenant or on-prem ETRM/CTRM, you’re storing all of your data on a physical, on-site server. Although it may seem protected, data can still be more vulnerable to internal risks.

In fact, a recent study from Microsoft shows that data breaches originating from inside an organization can cost businesses an average of $75 million annually. With an in-house server, you may have less control over who can access the server and the sensitive data it holds – which puts your information at a substantial risk.

However, the best multi-tenant SaaS ETRM/CTRMs have an established user permissions system that defines which team members can access select data. In addition, any entry or modification of the data is recorded in an audit trail. That way, your organization has control over who can access which data and can identify who made changes in your system.

3. MULTI-TENANT SAAS ETRM/CTRMS CAN BE EASILY MONITORED.

SaaS cloud ETRM/CTRMs can also handle operational risks through automated monitoring and rigorous testing. Multi-tenant SaaS vendors can constantly monitor the software in case any system outages, broken integrations, or other maintenance issues come up. If these tests pick up any issues, the vendor support team will be notified immediately. With single-tenant cloud or on-prem software, on the other hand, you deal with everything in-house – which can become costly, time-consuming, and lead to a lot of downtime.

These multi-tenant SaaS ETRM/CTRM vendors monitor and test your system remotely, 24/7. The best vendors run static and dynamic tests, static code tests, and pen tests – just to name a few. These tests help to monitor the system and reduce operational risks.

In addition to monitoring everyday operational risks, vendors can use established procedures and tests to monitor the risk of upgrades – with the best ones pushing updates frequently and automatically. These tests can determine if an upgrade will cause any disruption to the end user before it is released.

With 24/7 monitoring and testing for upgrades, you can avoid system outages and downtime. As opposed to on-prem solutions, the industry standard for cloud-hosted application uptime is at least 99.9%. Less application downtime significantly drives productivity and efficiency.

4. A MULTI-TENANT SAAS ETRM/CTRM IS MORE SCALABLE.

Scalability is a critical part of any successful company, especially in fast-evolving markets like renewables. For renewables companies, or trading firms adding renewables to their portfolio, spreadsheets (and, let’s be real: a lot of outdated ETRMs) just can’t handle the complexity and granularity of renewable instruments. They need a modern solution to easily manage large, complex datasets. Currently, 35% of renewable generators/developers say their ETRM/CTRM system does not handle everything they trade.

No matter what you trade, scalability is one of the most valuable benefits of a multi-tenant system, due to the cloud’s remote servers that can allocate resources, handle large and complex data, and adapt to evolving needs — without additional infrastructure. For optimal scalability, consider ETRM/CTRMs that run on modern, cutting-edge technology, including Kubernetes, PostgreSQL, and AWS. These applications can automatically scale servers based on trade load. In turn, you won’t have to worry about slow load times or outdated trade data.

On the other hand, scalability for single-tenant cloud or on-prem ETRM/CTRMs must be manually configured; it’s not automatic like it is on the multi-tenant cloud. This can lead to more downtime and higher costs for your company that you may not have anticipated.

5. A MULTI-TENANT SAAS ETRM/CTRM PROMOTES ADAPTABILITY AND INNOVATION.

One of the most fundamental differences between the multi-tenant cloud and single-tenant cloud or on-prem ETRM/CTRM is the ease of updates and emphasis on innovation and modern technology.

Many on-prem solutions still operate on the same outdated software from their original installation because updates can be cumbersome and expensive. Likewise, you won’t get the same frequency of updates with single-tenant cloud ETRM/CTRMs because there is no shared infrastructure. With a multi-tenant cloud solution, frequent updates are routine, so they won’t disrupt your operations.

As you consider your next ETRM/CTRM platform, find systems that update frequently and automatically. For instance, Molecule pushes out new updates approximately every two weeks. In addition, we offer add-ons and versions of our APIs to keep up with the speed of industry change and customer needs.

6. A MULTI-TENANT SAAS ETRM/CTRM IS MORE COST-EFFECTIVE.

With a SaaS ETRM/CTRM, software applications don't have to be built from the ground up for every customer. That means multi-tenant cloud ETRMs have a lower total cost of ownership (TCO) because they reduce implementation, maintenance, and support costs.

Since customers are hosted on the same multi-tenant platform, there are no additional variable costs with SaaS solutions, unlike single-tenant cloud or on-prem ETRM/CTRMs. Even better, some multi-tenant SaaS ETRM/CTRM quote packages and implementations on a fixed-fee basis, with updates included. That way, you can better account for those costs in your budget.

With on-prem, legacy solutions, or single-tenant cloud software, you may have to pay up to three times the license fee for implementation costs.

As your team works through the budget for a new ETRM, look for companies that are upfront about fees and pricing so that you can factor in all of the costs… or find a company that will do that for you.

Ultimately, SaaS ETRM/CTRMs yield many benefits for professionals in the commodity trading and risk management sector.

Editor’s note: This blog was first published in April 2023 and updated in December 2024.