Energy & Commodities Trading in 2025: What 400+ Respondents Told Us About ETRM/CTRM Modernization

The biggest takeaways from Molecule’s 2025 ETRM/CTRM Transformation + Modernization Report

Summary: The State of Modernization in 2025

2025 is the year energy and commodities trading companies stop talking about modernization — and start building it. Last year, the majority of companies were still mapping their plans. This year, modernization has moved from strategy to execution.

Priorities have changed from last year, too. Speed still matters, but control, scalability, and trust in data are now the real metrics of success. As portfolios grow more complex and renewables claim a bigger share of the mix, companies need systems that can keep up — without forcing workarounds or custom patches.

This year’s report, built from over 400 responses across 10+ industries, shows how far the market has come… and where it’s still stuck. The message is clear: firms don’t just want faster systems; they want systems that flex with their business, provide clear answers when the stakes are high, and remove the guesswork from risk and compliance.

This article breaks down the biggest takeaways from this year’s ETRM/CTRM Transformation + Modernization Report.

Table of Contents

- Top Takeaways

- Why Is 2025 the Tipping Point for ETRM Modernization?

- What Is Driving Modernization in 2025?

- Control, Scalability, and Confidence Are the New Winning Metrics

- Where Are Current ETRM Systems Falling Short?

- What Do Energy and Commodity Teams Actually Want?

- How Are Renewables Reshaping ETRM Priorities?

- What Role Will AI Play in Trading Operations?

- Why Modernization Will Decide Future Market Leaders

Top Takeaways

What’s shaping the energy and commodities trading market in 2025?

- 70% of companies have modernization projects already in motion (up from 24% in 2024).

- 94% have launched or planned modernization initiatives.

- ETRM/CTRM adoption has skyrocketed from 34% to 85% in one year.

- Scalability is the #1 driver for modernization (led by 43% of traders, 29% of producers, 25% of utilities).

- 64% say their current ETRM systems still don’t support all their processes or traded commodities.

- Operational visibility (31%) now beats agility (23%) as the top long-term risk priority.

- 91% expect AI to reshape trading operations within five years.

Why Is 2025 the Tipping Point for ETRM Modernization?

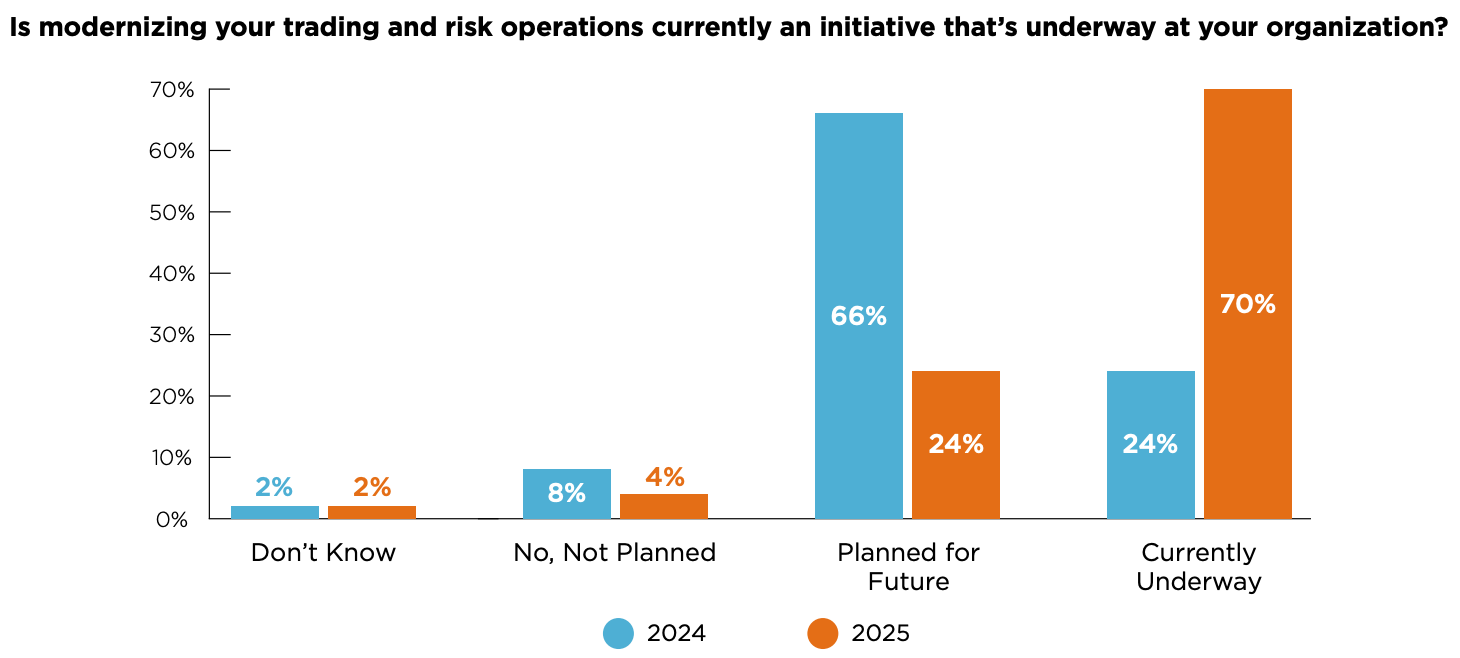

Modernization has shifted from a “future goal” to a current operational priority. In 2024, 66% of companies were still in the planning stage, with only 24% having a modernization initiative actively underway. In 2025, companies are fully committing to modernizing their trading operations.

- 70% already have projects underway, compared to just 24% last year.

- ETRM adoption jumped from 34% in 2024 to 85% in 2025.94% of companies have launched or planned modernization initiatives — nearly universal adoption.

The data underscores that modernization is no longer optional for companies that want to remain competitive, efficient, and compliant.

Companies that invest now are positioning themselves for future growth, operational efficiency, and compliance readiness — while those who wait risk falling behind.

What Is Driving Modernization in 2025?

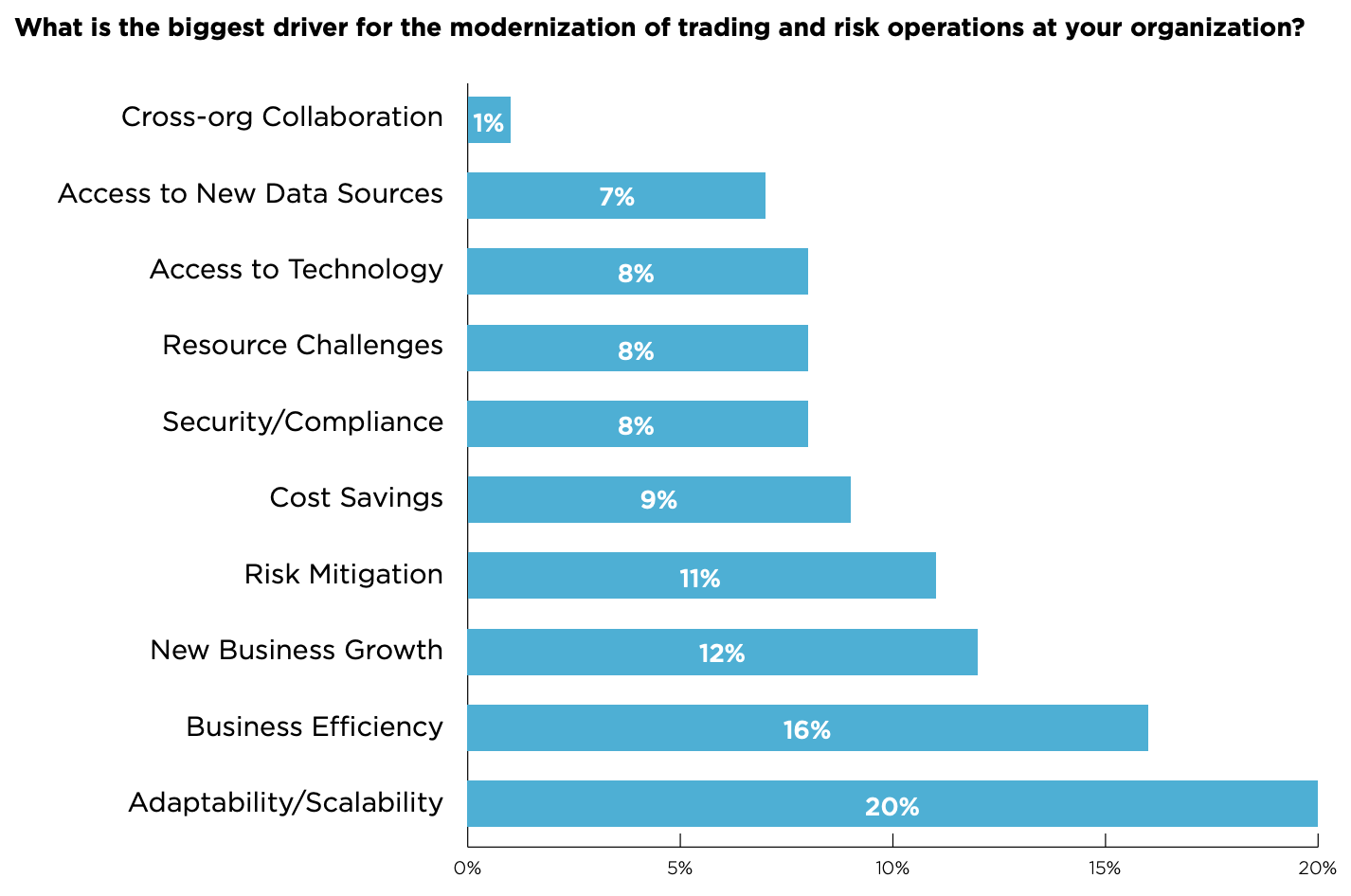

As portfolios grow more complex and market volatility increases, companies are doubling down on infrastructure that can scale and adapt.

- Scalability is the #1 modernization driver across most company types, particularly for Traders and Utilities where operational complexity is highest.

- 64% of respondents report that their systems fail to fully support critical business processes or the range of commodities they trade.

- Renewables have surged to become the most-traded commodity (42%), overtaking oil and gas.

- 91% expect AI to play a major role in reshaping trading operations within the next five years.

These numbers point to bigger trends shaping the industry:

- The rise of renewables and new products demanding more adaptable systems

- The need for integrated, automated tools that remove manual bottlenecks

- The race to stay ahead of evolving market dynamics

Together, they paint a picture of a sector undergoing significant digital transformation.

Control, Scalability, and Confidence Are the New Winning Metrics

Speed was a major theme of last year’s report, but it’s now the baseline expectation. What companies really want in 2025 are systems that provide confidence, control, and scalability — platforms that can handle both current needs and future growth.

Scalability leads the way:

- 43% of Traders, 29% of Producers, and 25% of Utilities identified scalability as their top priority.

- Business efficiency (16%) and new business growth (12%) are emerging as the secondary reasons behind modernization.

Control means better oversight, less manual intervention, and more reliable data. Scalability ensures that as portfolios diversify, your systems won’t break or slow you down. Confidence means trusting that your system will deliver accurate, timely insights that support critical decision-making.

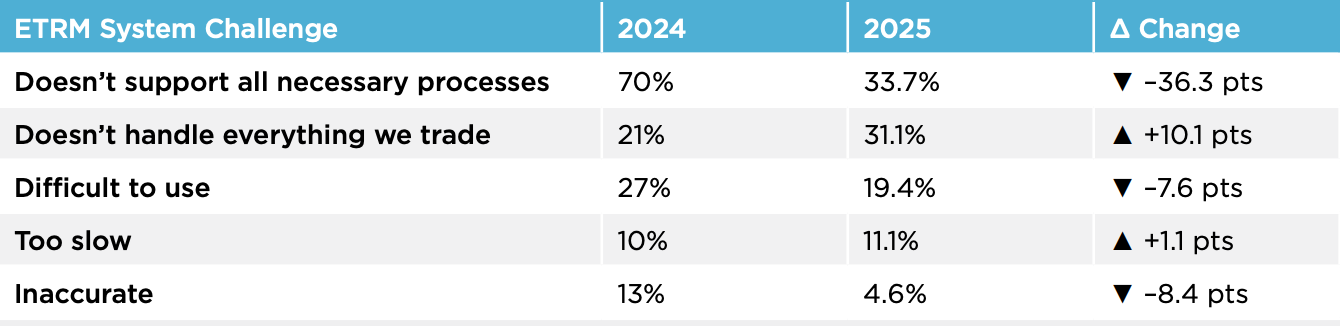

Where Are Current ETRM Systems Falling Short?

Even with new investments, most companies are still frustrated with their current system. Legacy platforms struggle to handle the speed, data, and product diversity that today’s trading environments demand.

- 64% of respondents say their system doesn’t support all necessary processes or trades.

- 31% say their system doesn’t handle all commodities — an increase from 21% in 2024.

- Fewer than 4 in 10 respondents say their system handles diverse trade types effectively.

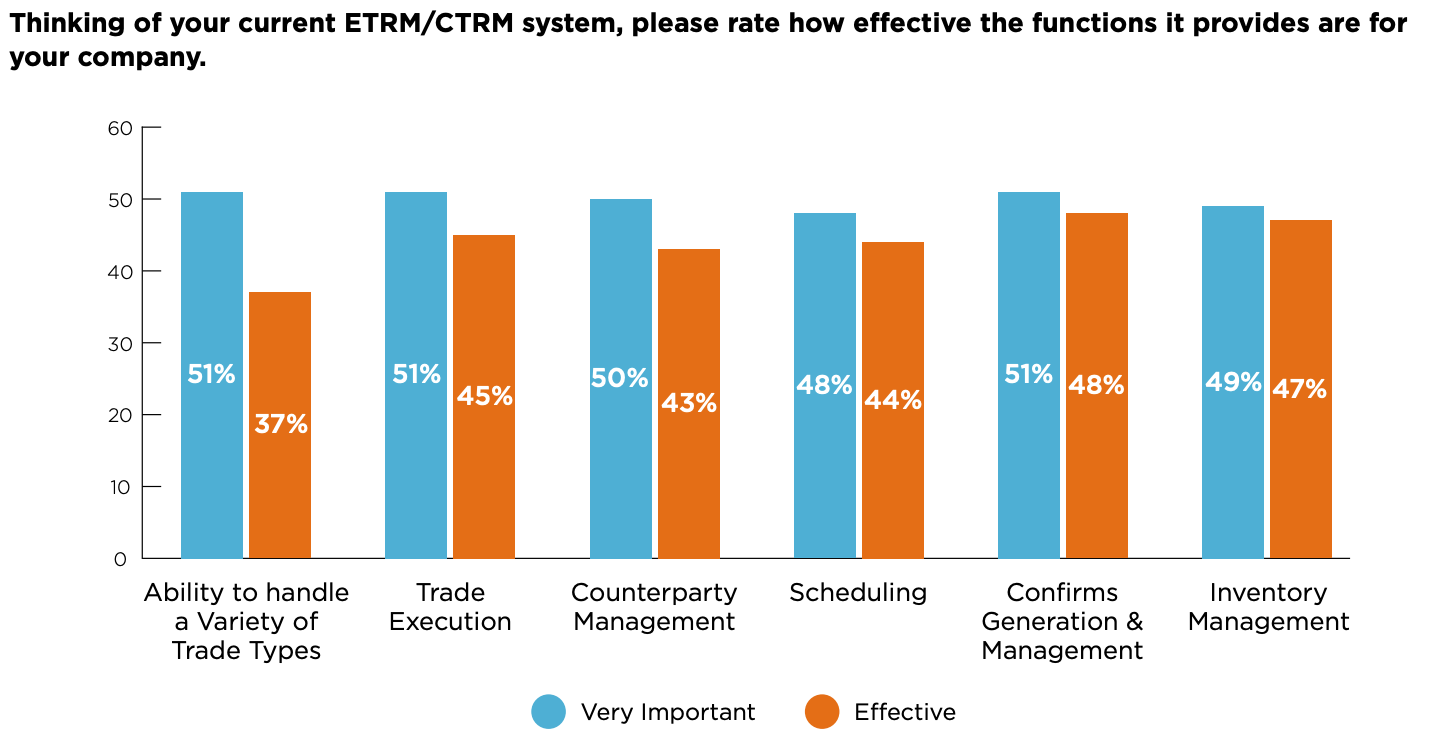

Functionality Gaps: Importance vs Effectiveness

Gaps in trade-type support, scheduling, and reconciliation slow teams down and create real operational risk. And as portfolios expand into renewables and more complex instruments, those gaps in effectiveness are expected to expand.

This growing mismatch between what teams need and what systems deliver is why modernization has shifted from a “nice-to-have” to a must-have. The systems many firms relied on simply weren’t built for today’s complexity — or what’s coming next.

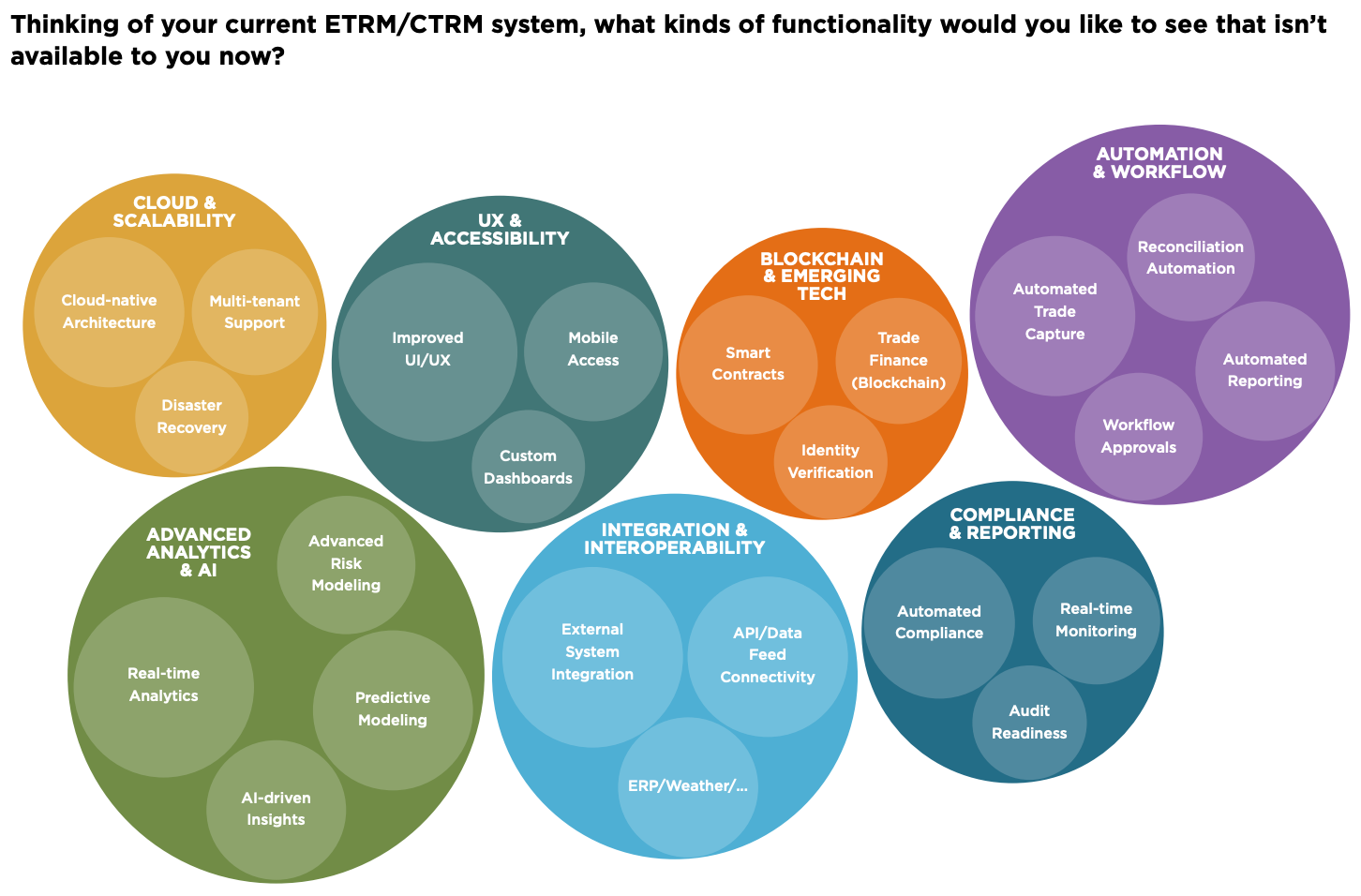

What Do Energy and Commodity Teams Actually Want?

When asked about missing functionality, respondents were vocal about the need for smarter, connected, and scalable systems. Modern ETRM solutions should remove bottlenecks, automate repetitive tasks, and provide a single source of truth for all trading activities.

- Real-time insights and dashboards for clear risk visibility.

- Automated workflows that minimize errors and manual work.

- Cloud-native infrastructure for easy scalability and faster performance.

- Straightforward integrations (especially APIs) that unify data across platforms.

- Advanced analytics for better forecasting, real-time analysis, and smarter decision support.

How Are Renewables Reshaping ETRM Priorities?

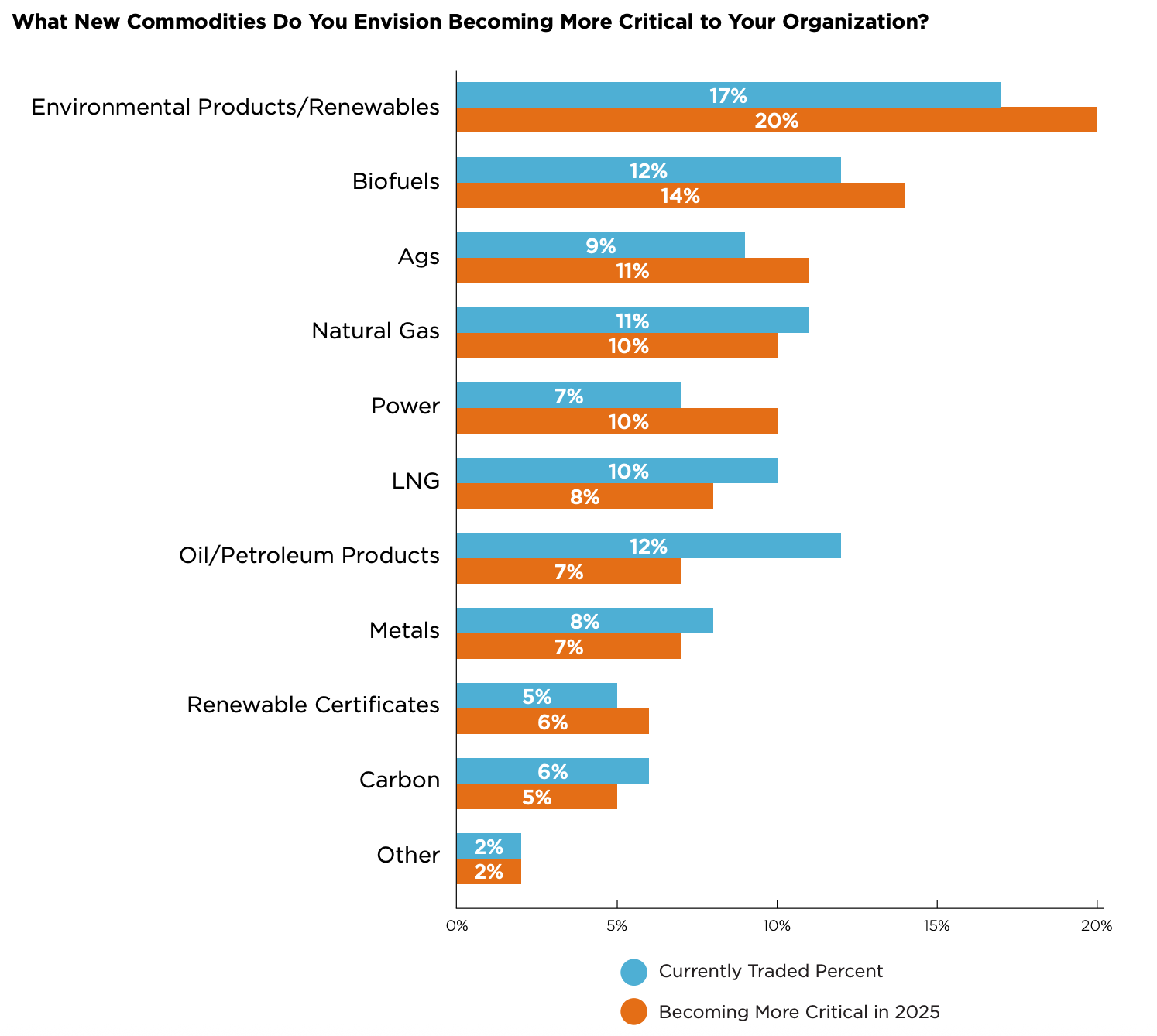

The growth of renewables trading means a growing shift in trading strategies, portfolio structures, and system requirements.

- 42% of respondents now trade environmental products — surpassing oil and gas for the first time in our survey.

- Biofuels (33%) and environmental products (30%) rank among the fastest-growing priorities, alongside renewable certificates and carbon markets.

- Legacy ETRMs are falling behind, struggling to manage the data demands, variable pricing models, and compliance reporting that come with these emerging markets.

Regulation is part of the shift, but the real driver is a strategic pivot toward low-carbon portfolios. Companies are leaning in to stay competitive, but that move creates new operational pressure: more complex trades, more data flowing between systems, and tighter reporting timelines.

Modern ETRMs have to keep up with today’s demands. That means supporting diverse products, near-real-time reporting, and carbon accountability — all while integrating with the rest of their trading tech stack.

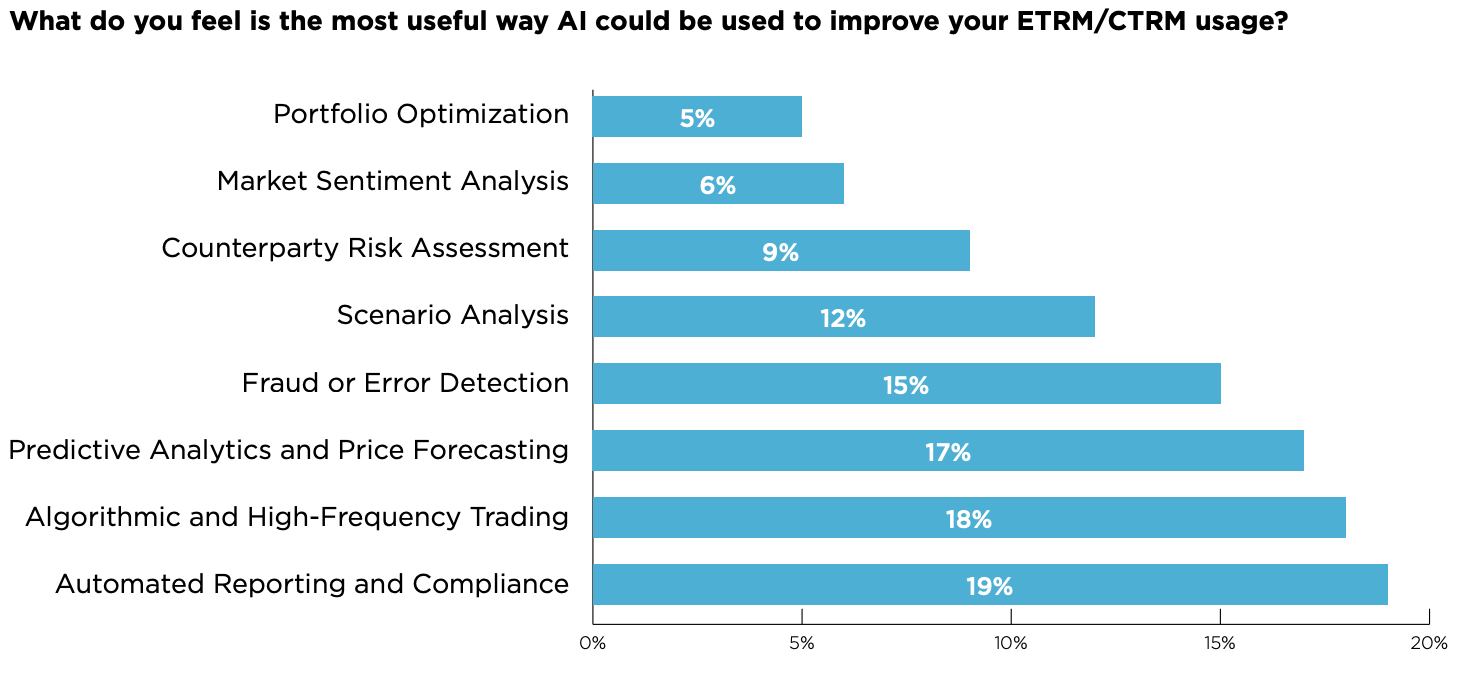

What Role Will AI Play in Trading Operations?

Artificial Intelligence is becoming a real, measurable force in ETRM operations, with trading organizations seeing AI as an operational accelerator.

- 91% believe AI will significantly impact their trading operations within 5 years.

Top use cases include:

- Automated reporting (18.7%)

- Algorithmic trading (18.2%)

- Predictive forecasting (16.8%)

- Fraud detection (15.1%)

Why Modernization Will Decide Future Market Leaders

In 2025, over 70% of companies now have active modernization initiatives underway, and ETRM/CTRM adoption has jumped to 85%. Companies aren’t just talking about upgrading their systems anymore — they’re doing it.

The drivers for modernization are shifting. In 2024, speed was a headline priority; this year, it’s about control, scalability, and clarity. This points to a maturing market that realizes that the tools they use need to do more than move fast; they need to help drive their business goals.

Today’s trading teams need systems that can handle multi-commodity portfolios, support tighter oversight, and deliver reliable, timely data when decisions can’t wait. As portfolios diversify and compliance demands rise, the gap between firms modernizing strategically and those standing still is widening fast.

“Good enough" isn’t good enough anymore. Companies modernizing now are better positioned to make decisions they can trust, manage risk strategically, and maintain their edge as the market continues to evolve.