7 Reasons You Should Move from Spreadsheets to ETRM Software

ETRM software is specifically designed to calculate position, manage the lifecycle of trades, and offer real-time valuations and reports. So, why are some risk managers still using spreadsheets to manage their trade portfolios?

Well, there are some benefits to using spreadsheets. They are:

- Easy to use and modify

- Customizable and flexible

- Easy to adopt because you already have them (and who doesn't use Excel?)

At Molecule, we've seen some impressive spreadsheets. We've also seen how detrimental spreadsheets are for risk management. One error, something as simple as a typo or deleted cell, can throw off reports and cost thousands of dollars.

As your portfolio grows in complexity, so do your spreadsheets, and so does the likelihood of errors and miscalculations.

"We understand that when you're giving up your spreadsheets, it can feel like you're giving up some of your freedom. With Molecule's ETRM, however, what you get in return is more power, capability, and security, along with a great interface." – Tamasin Ford, Chief Operating Officer at Molecule

Whether you're a company with a growing portfolio or still clinging to your spreadsheets out of habit, read on to see how the move to an ETRM will transform your efficiency, valuations, reporting, and auditability.

Table of Contents

- How does ETRM software improve efficiency?

- How does ETRM software enable informed decision-making?

- How does ETRM software provide comprehensive valuations and risk metrics?

- How does ETRM software hit the sweet spot of standard and custom?

- How does ETRM software optimize design and usability?

- How does ETRM software offer enhanced scalability?

- How is ETRM software more auditable?

1) How does ETRM software improve efficiency?

Spreadsheets may be easy to use, but they lack efficiency.

Where ETRMs automate most tasks, spreadsheets involve tedious manual entry of data and calculations. Investing in an ETRM reduces manual errors by streamlining data entry workflows, automating reports as you trade, and effectively managing higher volumes of data.

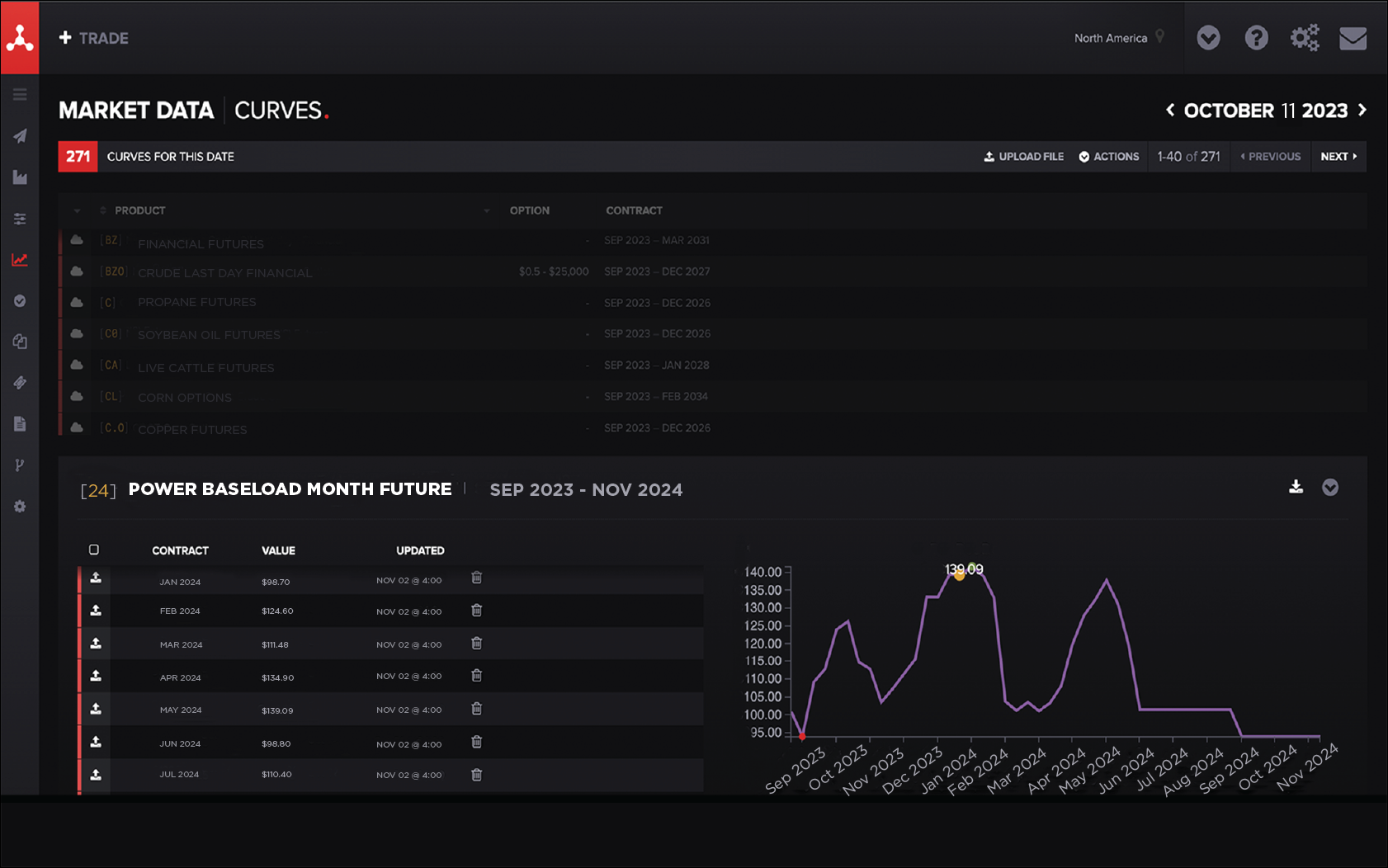

For instance, marking trades in a spreadsheet involves lots of copy-paste. First, copying prices and then copying formulas. With an ETRM like Molecule, you can use a simple spreadsheet upload template or our modern API endpoints to load forward curves with minimal user effort.

Then, our valuation engine kicks in to automatically mark your trades, calculate P&L and several other metrics, and roll up the value of your portfolio or output risk metrics on reports. You'll be tracking these values every day of a trade's life. With spreadsheets, that either grows into an unmanageable mess of daily data, or you don't have a comprehensive view of your trades' lifecycles over time.

ETRMs also improve efficiency because of their integrations. Unlike spreadsheets, Molecule integrates market data from 15+ exchanges, industry-standard data providers, and every North American ISO. This market data automatically uploads into our ETRM and creates a new position and valuations in near real-time.

In turn, ETRMs will match or exceed your spreadsheet's efficiency on nearly every daily task.

2) How does ETRM software provide accurate reports for better decision-making?

Up-to-date data reduces risk through more accurate, relevant, and timely reports. Since spreadsheets require manual data updates, there may be times during your trade's lifecycle when data and reports may be outdated and misleading.

For example, here's how quickly your data updates in the Molecule system:

- Daily market data updates or whenever user marks are loaded

- Trade data updates in real-time

- Valuations calculate in near real-time

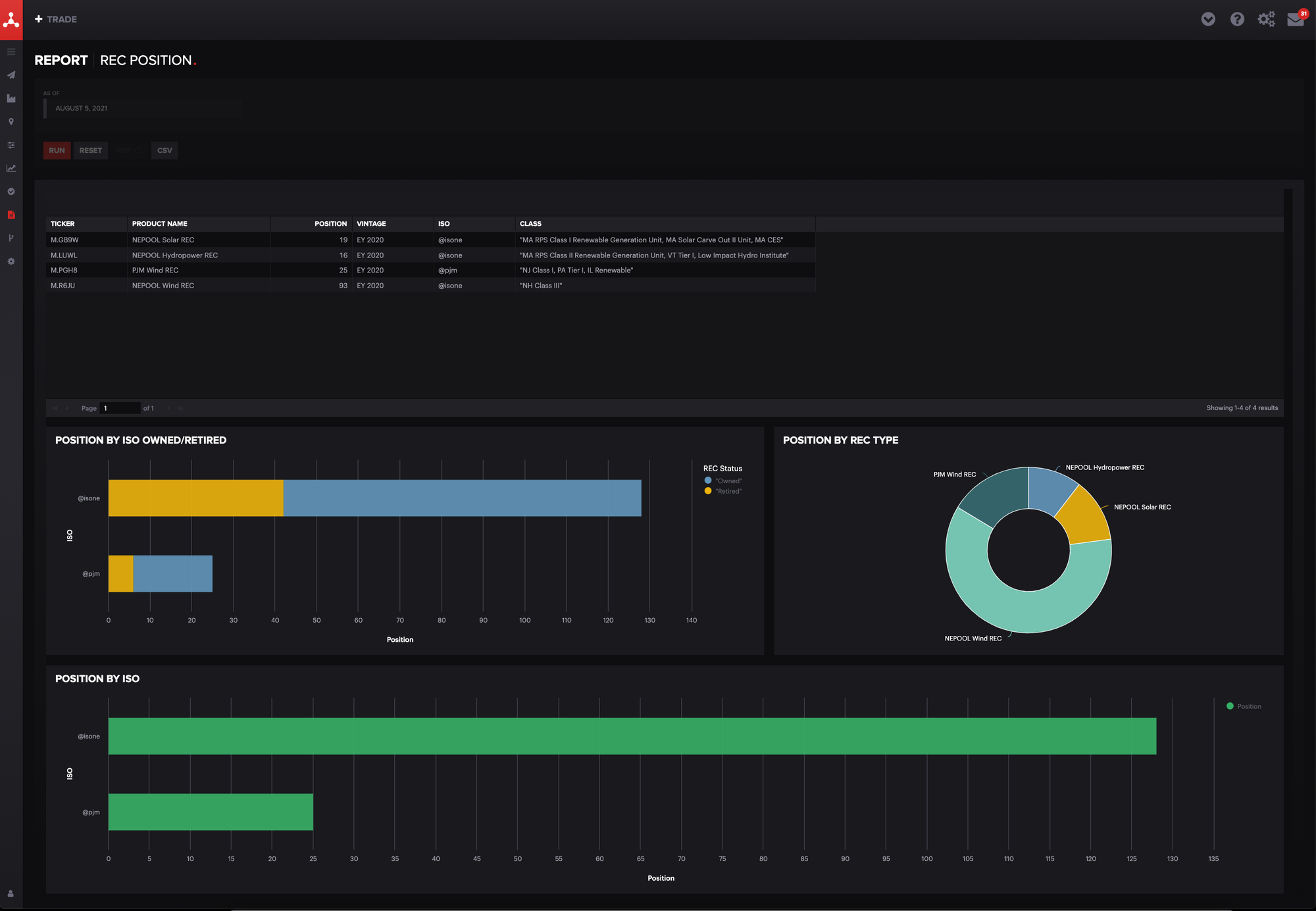

During times of uncertainty and volatility, accurate reports are vital to assessing risk exposure, making informed decisions, and proactively mitigating risk. ETRMs help you build reports from real-time market data for hedging, compliance, and monitoring up-to-date positions, P&L, and exposure.

You may have some team members reluctant to abandon their spreadsheets. With Molecule, they don't entirely have to. If you pair a spreadsheet or other BI tool with Molecule's APIs, the Molecule system updates your external data and reports each time you access it.

3) How does ETRM software provide tested and comprehensive valuation and risk metrics?

There are a lot of potential calculations and metrics to help you measure and assess the risk exposure of your portfolio. While spreadsheets require you to build and test each individual metric, ETRMs provide a comprehensive set of over a hundred built-in valuations and advanced analytics.

Here are just some of the valuations and metrics that Molecule calculates:

- Automated Position and P&L Calculations

- Multiple Option Models (including Black-76, Turnbull-Wakeman)

- Option Greek Calculations

- Volatility Implication

- Strike Interpolation

- UOM Conversions

- FX Conversions

- Balmo Calculations (aka Decay)

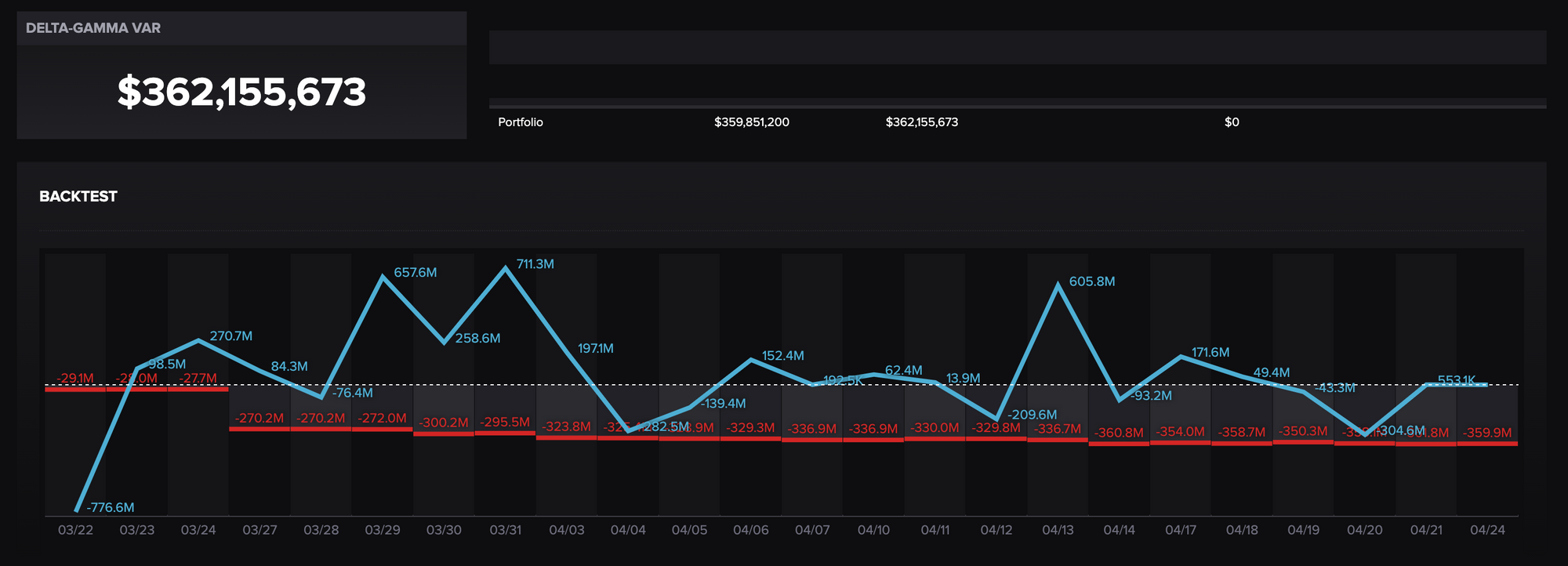

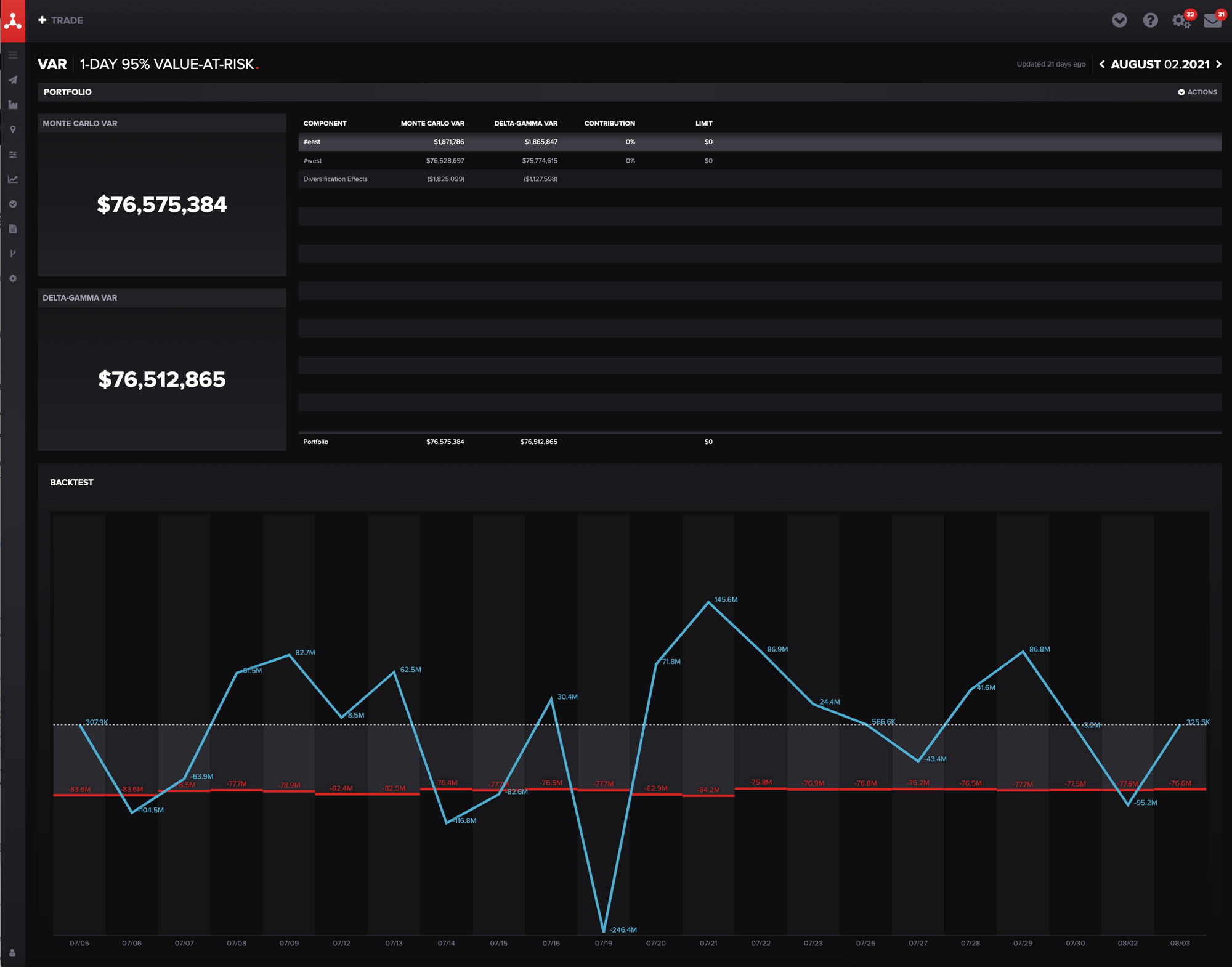

- VaR (Monte Carlo, Delta-Gamma)

- Priced/Unpriced Calculations

- Inventory Valuation

- YTD/QTD/MTD Calculations

Although spreadsheets may be easy to start and run, they can only do a small fraction of what an ETRM can do before they start to become overly complex and error-prone. A spreadsheet that implemented this entire list would be massive and unwieldy.

Consider day-over-day reports. It's challenging to build YTD/QTD/MTD reports without replicating data across multiple spreadsheet tabs, which will rapidly become complicated in the volume of data and ensuring that formulae are correct.

An ETRM, on the other hand, has tested and validated calculations for complex reports and metrics. You can see today's P&L with calculated changes from yesterday's, last month's, and even the previous year's metrics in minutes.

In turn, an ETRM's automated valuations, reports, and data visualizations give you a holistic view of your risk exposure and the value of your portfolio.

4) How does ETRM software hit the sweet spot of standard approaches and customizations?

Spreadsheets are generic and multi-purpose, but sometimes a fit-for-purpose tool gets you much further.

An ETRM streamlines your unique business processes because it understands commodities, trade lifecycles, risk metrics, and more. While spreadsheets can only be custom-built, ETRMs have tested and reliable industry-standard features and data models available right out of the box – so you will need less customization. The customizations you do need will leverage this robust foundation.

For instance, Molecule's implementation team builds the following customizable features directly into our ETRM app:

- Custom fields for grouping, mapping, and reporting

- Custom curves built at your direction

- Custom reports for tailored analysis of your portfolio

The Molecule platform also allows you to:

- Control how trades are entered, filtered, sorted, and grouped

- Remove, select, and drag columns for trades and valuations

- Control trade amendments, such as cloning, transferring, splitting, and voiding

In turn, ETRMs can offer just as much – if not more – customization than your spreadsheets.

5) How does ETRM software prioritize design and usability?

As opposed to spreadsheets, ETRMs provide optimal design, which is vital to a positive user experience. Although design may not seem like a priority when it comes to your new system, here are some of the benefits of well-designed software:

- Frequent updates

- Ease of adoption

- Increased usability

Your energy trading risk management software should be designed to be adapted and updated. It should support seamless updates that won't disrupt customers or its infrastructure.

Moreover, to stay on top of risk, software needs to stay on top of the industry's demands and customers' needs. Be on the lookout for systems that release new updates every couple of weeks. Frequent cadence of updates shows your system prioritizes innovation and cutting-edge technology.

6) How does ETRM software provide enhanced scalability?

Although spreadsheets can be a great business tool, you can quickly outgrow them as your portfolio grows. They're not able to scale to business needs like an ETRM.

The more trades you import into your spreadsheets, the less functionality and control you'll have. ETRMs, on the other hand, were built to handle considerable amounts of trade data. The scalability of ETRMs depends on the type of ETRM and where it is hosted.

Here's an overview of the ETRM landscape:

- On-prem ETRMs that are single-tenant (privately hosted)

- Cloud ETRMs that are single-tenant (privately hosted)

- Cloud ETRMs that are multi-tenant (publically hosted)

To maximize scalability, consider a multi-tenant cloud ETRM. Molecule, for instance, scales servers based on the day's trade load. In turn, your team doesn't have to worry about system outages or slow load times.

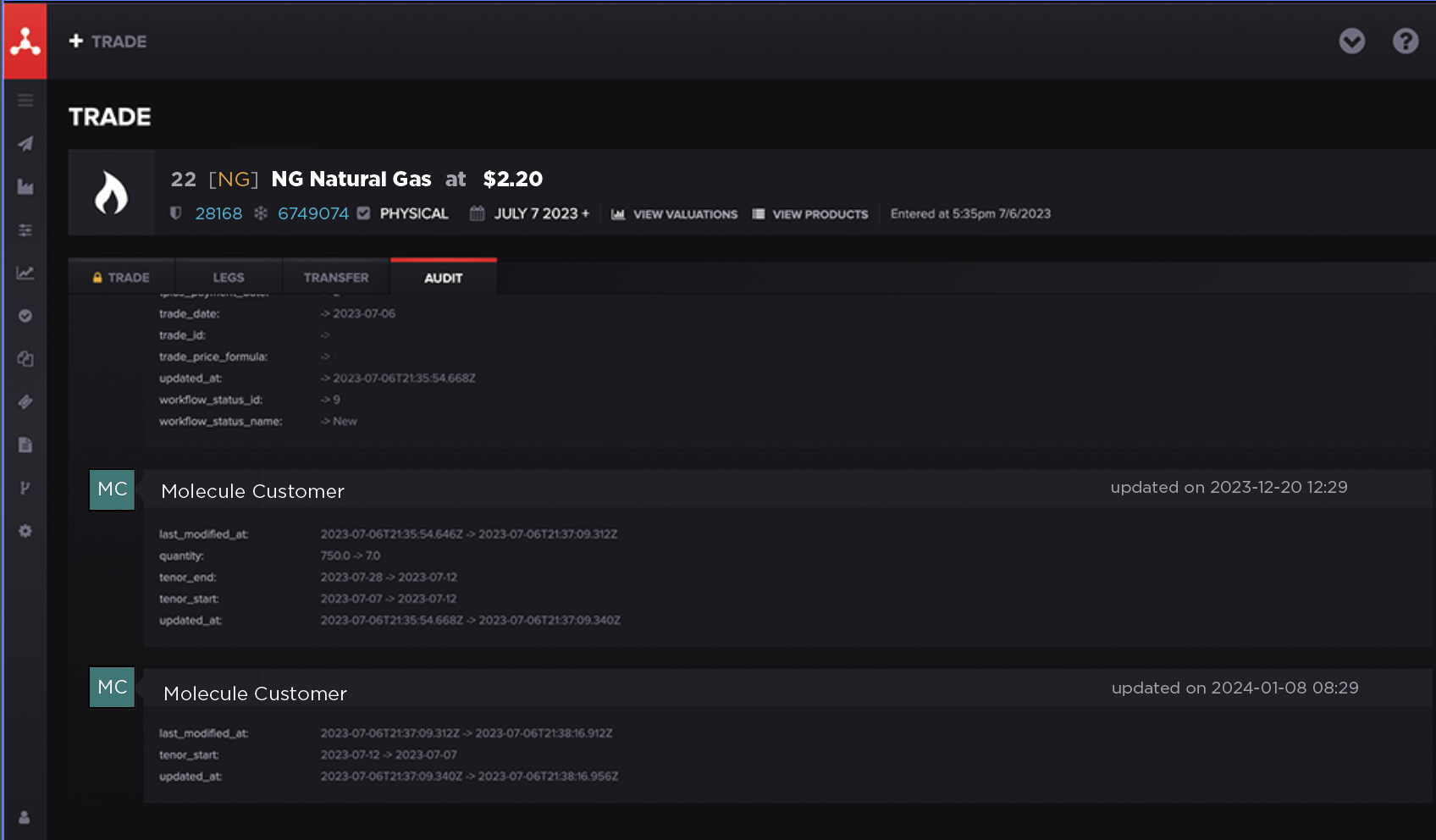

7) How is ETRM software more auditable?

Auditability can help protect your sensitive portfolio data from human errors, unauthorized access, and other forms of data corruption. If your company wants to protect your data, you shouldn't use spreadsheets for risk management.

You can't see the history of a trade in a spreadsheet the way you can with ETRMs. With no audit trail or record of the lifecycle of a trade, monitoring risk exposure in your portfolio will be challenging. You also cannot trace if someone broke a formula, deleted a cell, and so on.

Not only does Molecule provide audit trails for all of your trades, but our calculation engine is protected by layers and layers of tests, backtests, and change management processes to ensure nothing gets broken and valuations remain accurate.

With Molecule's ETRM, you also have more control over authorized user access – allowing you to designate which team members have permission to enter, modify, or view different aspects of your portfolio.

An ETRM incorporates everything you love about spreadsheets with increased efficiency, scalability, and usability.

RELATED POSTS