Happy Holidays 🎉 & Molecule Updates

It’s the end of 2020 (finally), and at Molecule, we’re super proud of our product, team, and the damage we’ve done to the ETRM industry (#1 in cloud ETRM – w00t!).

Here are a few highlights of what we’ve done to our product this year:

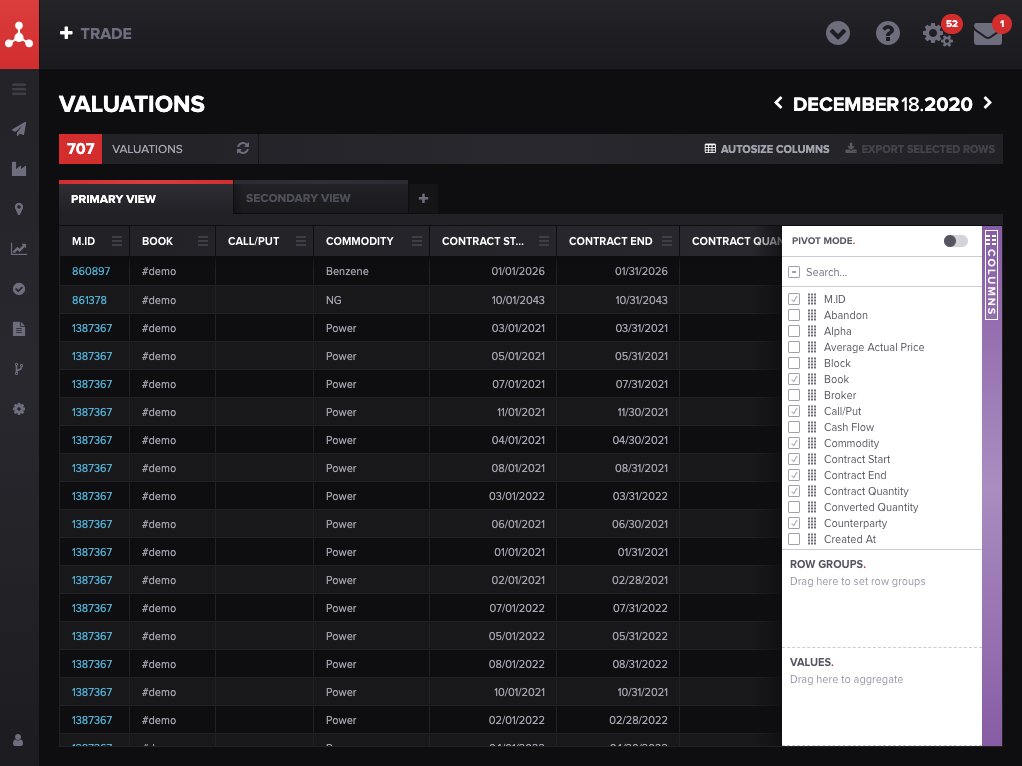

Valuations Screen / Quickview

Tired of downloading spreadsheets to diagnose an issue? We were! We built a shiny new screen called Valuations to handle that. On Valuations, you can access all the data available on our Valuations API (i.e., via spreadsheet), and make saved, customized, pivotable views of your portfolio. Want to learn more, or get a preview? NOTE: You must have the “Positions” screen privilege in Molecule, to get access.

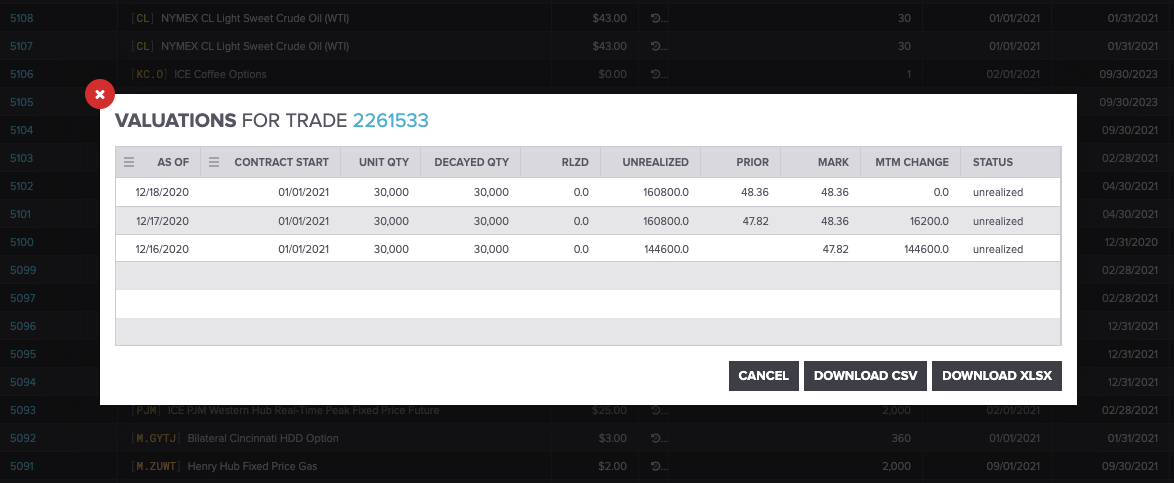

For quick access to how a single trade has valued over time, you can now: 1) right-click on a trade on the new Trades screen, or 2) click “Show Valuations” while in the Trade Edit view. You can even download the data, to diagnose further. Easy!

2. More Secure Sign-On

Security is paramount at Molecule, and to that end we rolled out options for two-factor authentication (via a rotating code on users’ phones) and SAML login. This is a huge deal and we highly recommend at least turning on two-factor for your organization (at no extra cost).

SAML login is even better (as it connects to your organization’s single sign-on system), and is available on our Enterprise plan.

3. Physical Power Enhancements (Elektra)

An increasing percentage of our customers trade physical power – so we’ve made lots of enhancements to make your lives easier. We rolled out better hourly (even 1-minute) power support – so trades, market data, and positions can all share the same product codes and be grouped appropriately. Nearly all power customers have been moved over to this scheme.

We also announced that we’ll provide LMPs (and settled blocks) to physical power customers automatically in Molecule – to eliminate the mapping and data-wrangling exercise (and maintenance) otherwise needed to settle power trades. The first version of this is scheduled to roll out in January and we plan to gradually replace LMPs from all other sources (except those uploaded by users) in early 2021.

Our physical power improvements come under the new Elektra package and we hope to have much more to share on this next year.

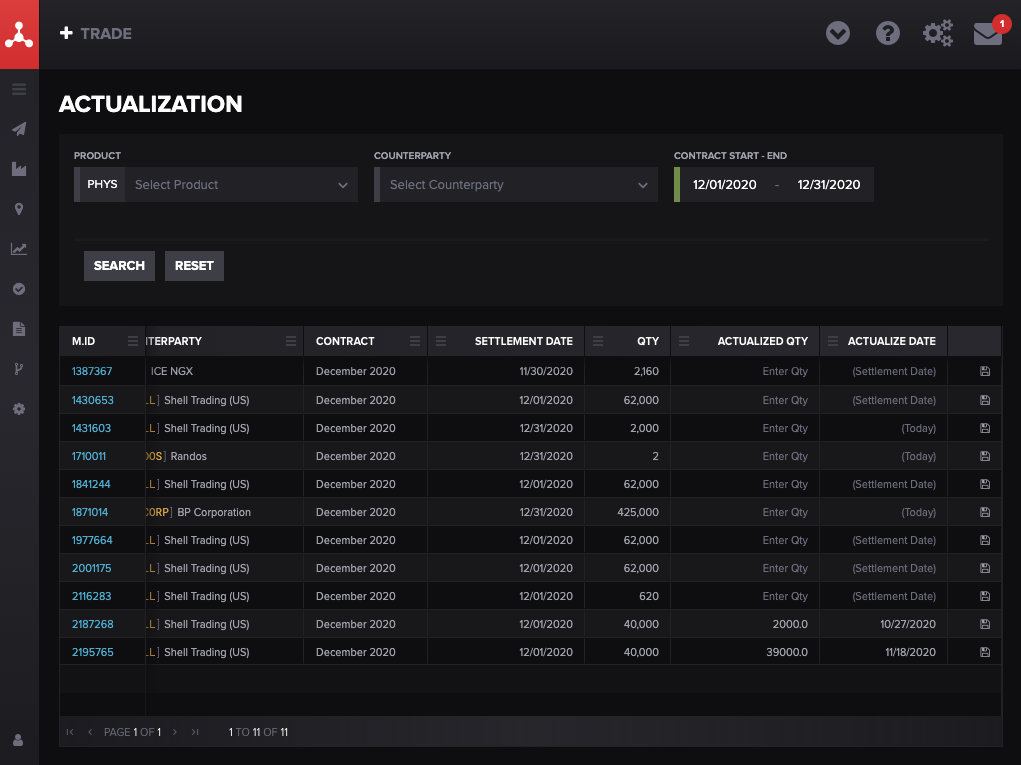

4. Actualization

We saw a significant increase in physical non-power trading on our platform in 2020. To help with that, we rolled out a new, consolidated Actualization screen. It’s fast and easy and we are continuing to add new features to it based on feedback from customers.

We have lots more features planned for next year, related to physical trading. These include contract management, limits, and GL account management. Please keep your eyes peeled!

5. P&Sing

Finally, in 2020 we rolled out a super-nerdy feature that, if you can get past its name, is super-important. For companies who trade on exchanges, we now support same-day + FIFO – based P&Sing.

What does this mean? It means that, if you’d like, we can flip a switch and close out exchange positions as they’re closed at your bank. Which, in turn, means, you can get a better breakdown of exchange-based realized and unrealized P&L. This can also dramatically reduce the number of lines on your valuation/P&L reports if your company does a lot of exchange trading.

We drop new features all the time, and we made lots of other important improvements to Molecule this year as well, including finalizing the new Trades screen (old one being retired in Q1), support for bilateral strips, support for several new FCMs, improved decay functionality (for intramonth/balmo valuations), and improved settlements functionality (so you can now mark and settle vs different products).

Thanks so much for being interested in our company, and/or using our product. We ❤️️ you, and we can’t wait to share many more new improvements with you in 2021!