3 Ways to Use CTRM Software for Day-to-Day Commodity Risk Management

CTRM software offers a variety of front, middle, and back-office features for commodity risk management. Their usability and scalability make them an essential component of effective day-to-day risk management.

Multiple roles can use CTRM software to help automate daily workflows, from managing trade and market risks and aggregating data at the trade desk and commodity level to monitoring credit and operational risks.

From a high level, you can divide day-to-day risk management into three categories:

We’ll delve into each of those and explain how a CTRM helps to monitor and manage these risks.

How does CTRM software assist in managing trade risk?

Trade risk management deals primarily with monitoring trading and hedging activity.

Here’s what trade risk consists of:

- Trade Limits: Preset restrictions on individual trades defined by quantity, tenor, and value.

- Trader Limits: Preset restrictions of quantity exposure and value risk that each trader is permitted.

- Hedging: Quantity and price hedged and unhedged positions used to mitigate risk.

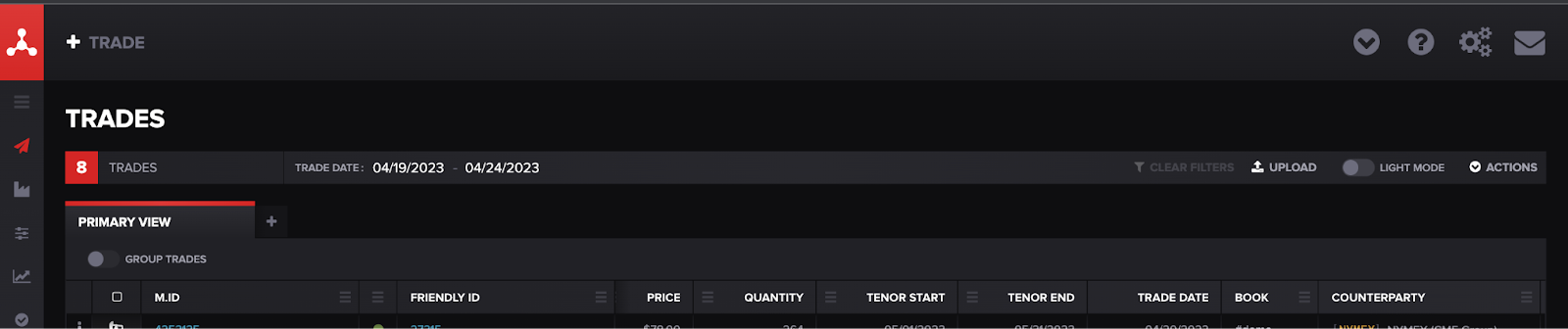

CTRMs can keep track of trade and trader limits by making it easy to enter and view associated trade data. For instance, much of this data is easily accessible on Molecule’s main trades screen.

Easy entry and access save time and lead to more efficient monitoring of limits and risks.

In terms of hedging, ETRMs like Molecule allow you to enter trades, integrate market data, and quickly calculate your portfolio’s value. For instance, Molecule's simple trade entry feature, spreadsheet upload tool, and API allow you to promptly load your trades into our system.

Furthermore, CTRMs have built-in integrations. With built-in market data connectors, Molecule connects to all the major exchanges (i.e., ICE, CME, Nodal, and more) and North American ISOs (i.e., ERCOT, PJM, CAISO, NYISO, and more).

With your credentials, your trades will instantly flow into our multi-tenant, cloud-native CTRM system and update automatically in near real-time. Once your trades are in the CTRM, you can easily keep track of your trade quantity and positions for hedging.

How does CTRM software assist in managing market risk?

Managing market risk involves monitoring market changes and their influence on the commodity, market, and portfolio/trading desk.

Here are some ways you may be monitoring market risk today:

- Risk Valuation: The basic tracking of mark-to-market and P&L of day-to-day or period-to-date changes.

- P&L Attribution: Provides insights into the attributes that contribute to the change in P&L, including new trading activity, market price changes, and trade settlement changes.

- VaR: Gives high-level insights into potential “normal” losses given your entire portfolio and risk factors.

Built-in valuations and reports make CTRMs fully equipped for market risk management. For instance, Molecule’s customizable screens allow you to choose from over 150 valuation attributes and risk metrics. You can track everything from MtM change to option Greeks.

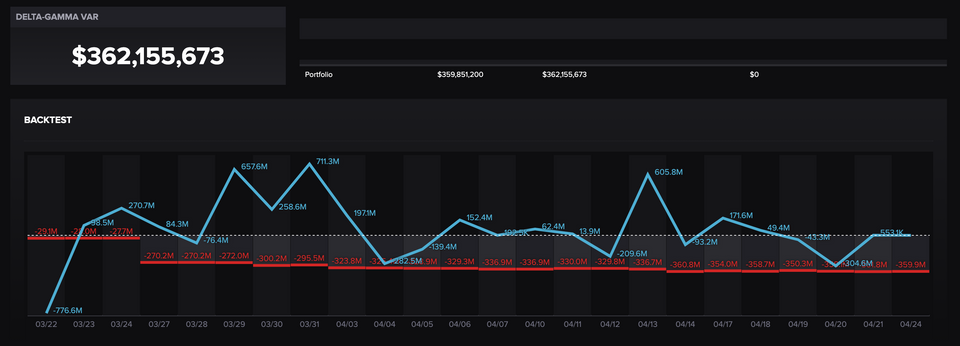

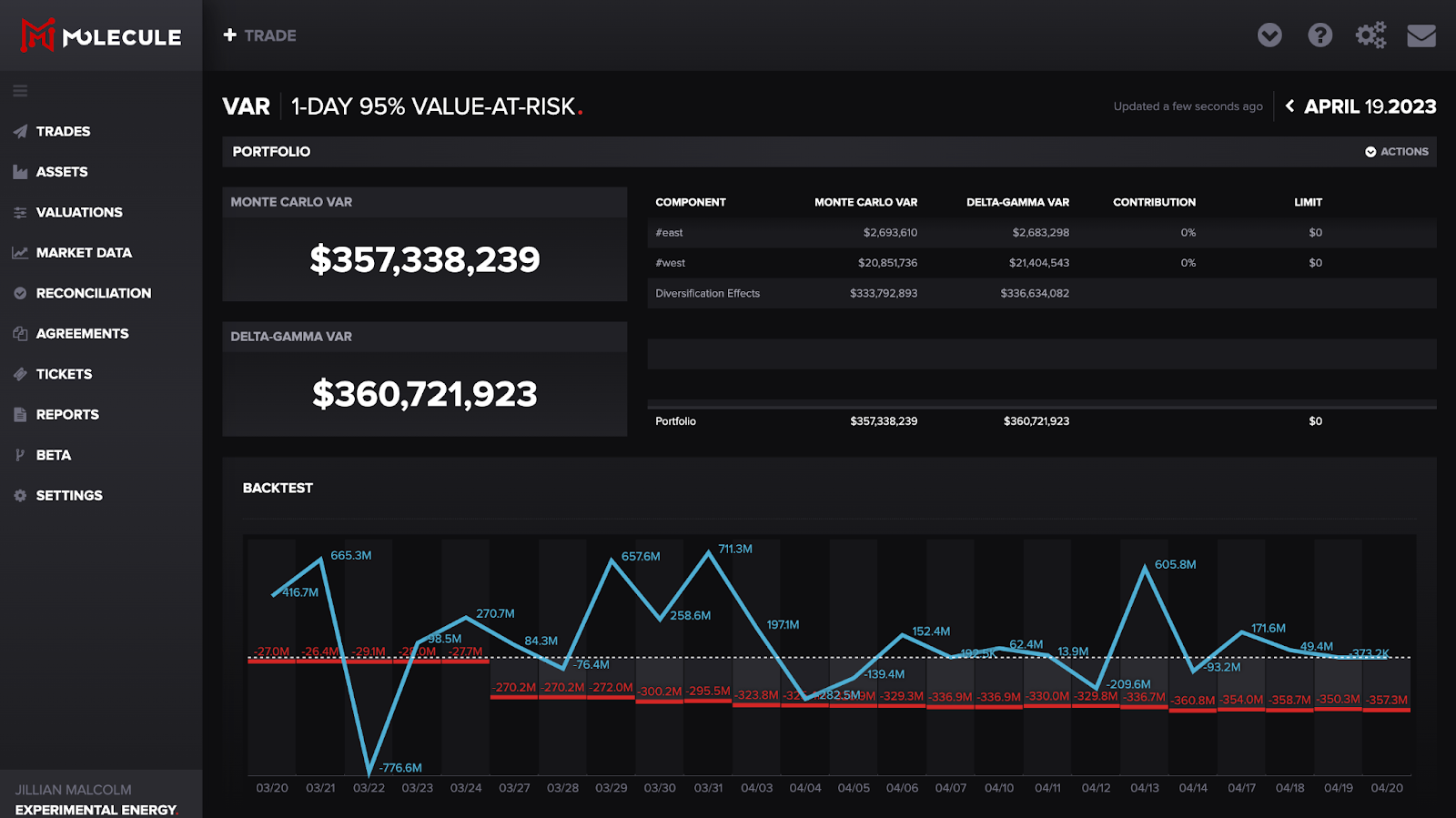

You may also have access to advanced analytics, like VaR.

The VaR screen gives you a quick glimpse of your Monte Carlo and Delta-Gamma VaR, contribution percentage, limit, and overall portfolio value. Our app also runs a basic scenario analysis with percent increases and decreases.

With APIs, you can also build custom reports, tools, and integrations straight from the application. You can also easily extract trade data (i.e. positions, valuations, and settlements) or pull real-time ETRM data into Excel or PowerBI for further manipulation.

With Molecule’s partnership with cQuant.io, you can also use advanced risk analytics and what-if analysis for additional market risk monitoring.

How does CTRM software assist in managing credit risk?

Assessing and managing counterparty risk is essential to credit risk management to maintain contractual agreements.

To do so, CTRMs give you the tools to monitor:

- Counterparty Credit: Establish limits and actively oversee a counterparty’s credit exposure.

- Collateral Management: Make appropriate collateral calls to ensure credit exposures remain within established limits.

- Risk Adjustment: Discount P&L based on a specific counterparty

- Contract Management: Outline settlement characteristics for multiple contracts under specific counterparties

For instance, you can upload counterparty information directly into the Molecule app, including contact and location information, risk adjustment, limit, collateral, and more from our counterparty’s screen, and then easily view counterparty data to monitor credit risk within your trade portfolio.

And, you don't want to miss some of our related posts: