ETRM/CTRM Solutions for Funds

Optimize your energy and commodity trading and risk management with Molecule's automated deal capture, comprehensive risk valuations, FCM reconciliation, and intuitive reporting features.

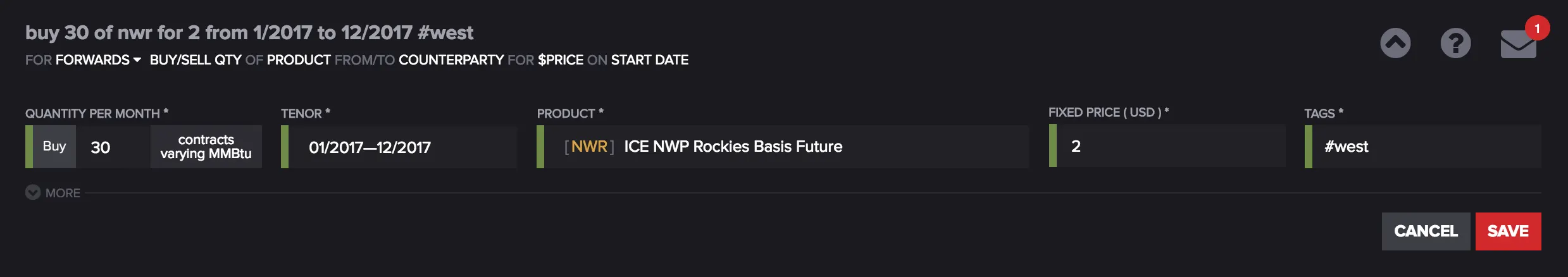

Automatic Deal Capture

With Molecule, your trades flow in instantly, through our built-in ICE, CME, Nodal Exchange, Trayport, and ISO connectors. Trading elsewhere? Use our spreadsheet upload, our API, or even better—our natural language recognition for OTC trades.

Market data comes your way automatically (and for free, in most cases), using our out-of-the-box market data service.

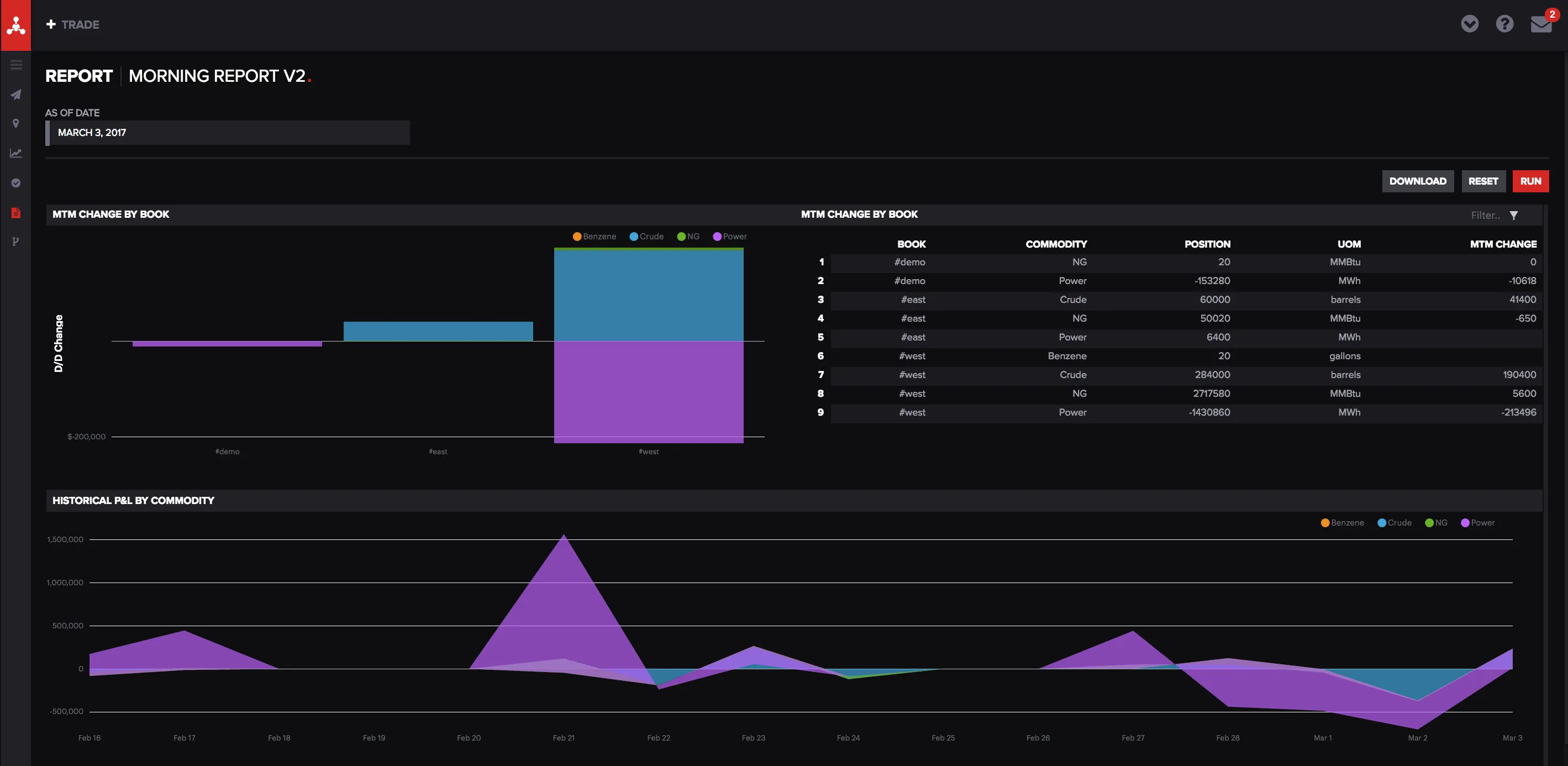

Automatic Position, P&L, Risk

End-of-day reports happen automatically, and accurately. Everything in Molecule calculates as soon as the system has sufficient data. Positions are calculated instantly. Trades are marked, and option greeks calculated, when market data comes in.

Molecule uses industry-standard Black-76 and mark-to-market calculations, as well as QuantLib. We also open-source key components of our software, so you can inspect them yourself — and be sure your reports are right.

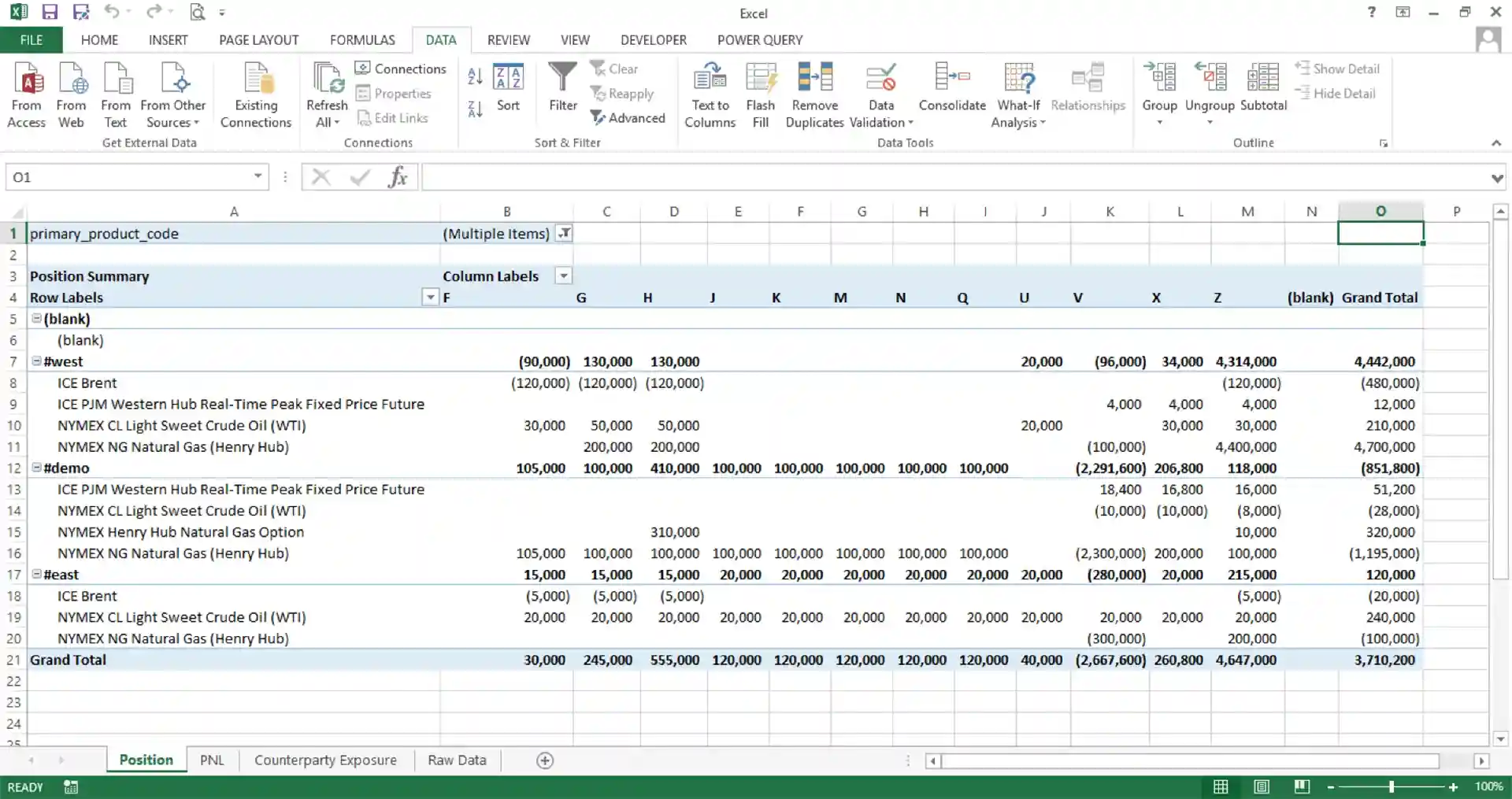

Want to use your old spreadsheets for reporting? No problem. Molecule can be wired directly to your Excel sheets, to show you the right information, the way you're used to seeing it. Want custom reports? Every package comes with a set of custom reports we can make for you.

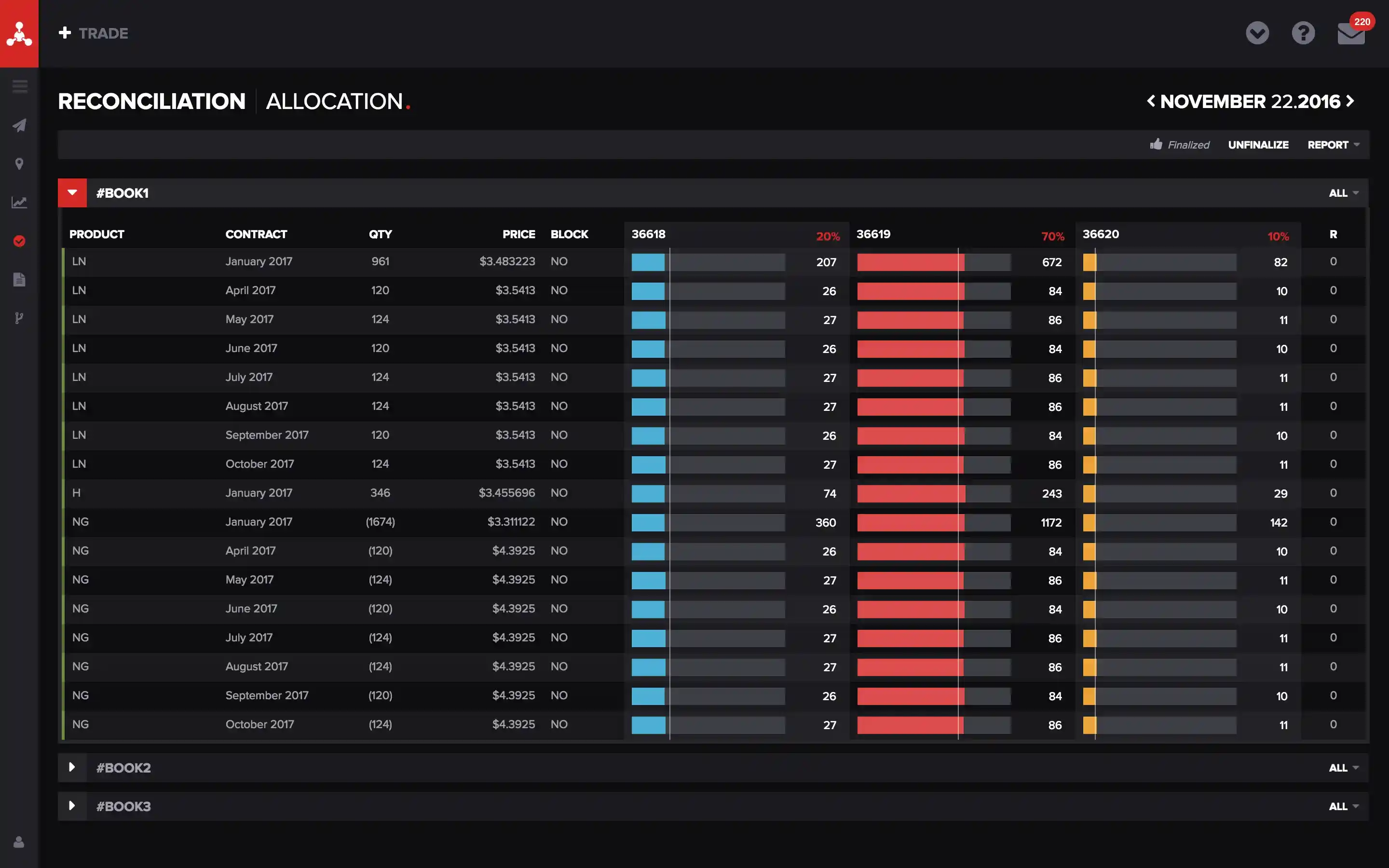

Fund Allocation

Do you allocate funds between different accounts, and send those instructions to your bank? Molecule has built-in functionality to allocate automatically all day, and let you update the allocations at will. Then you can send our output to your bank—or let us do it for you.

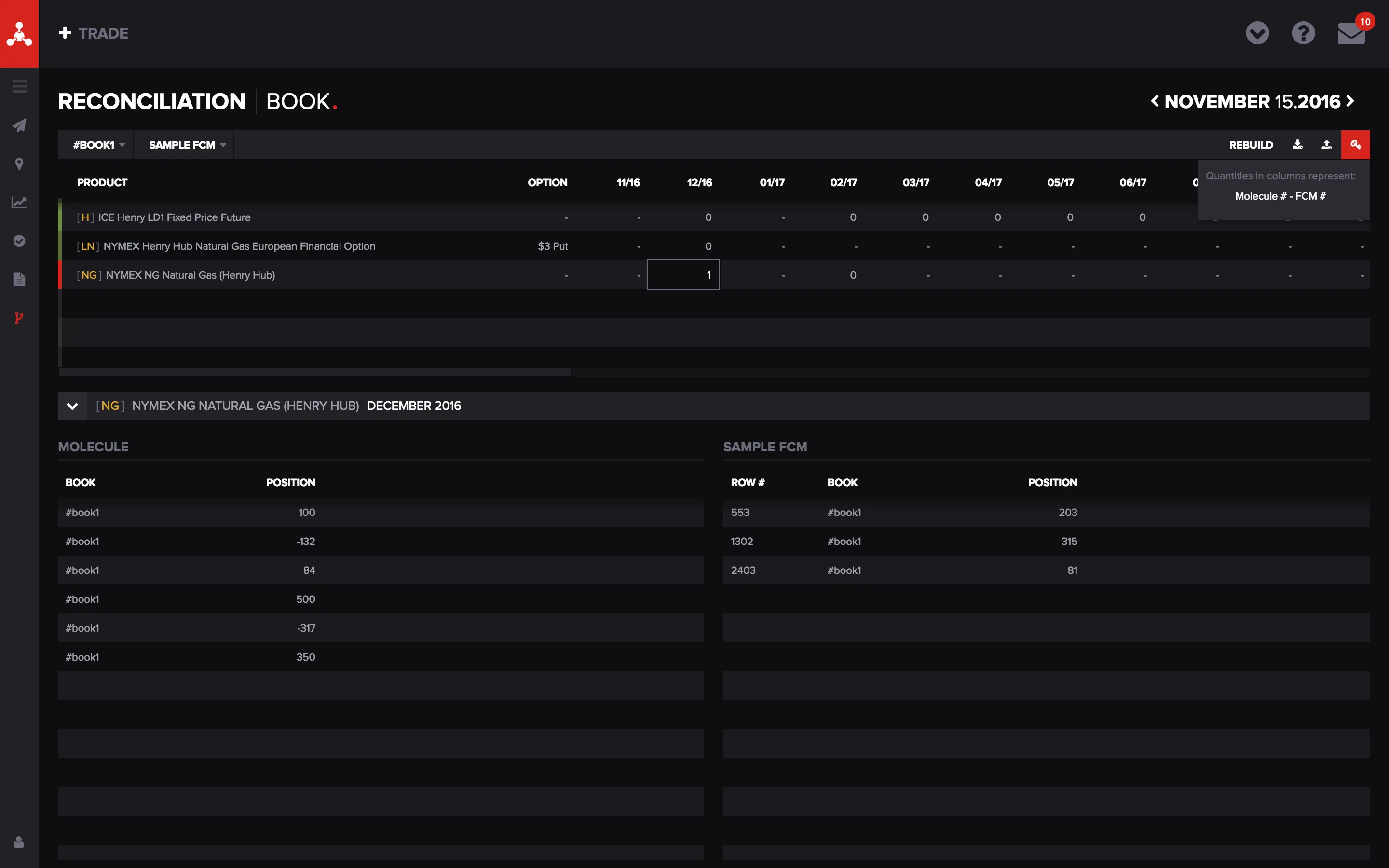

Bank Reconciliation

Ever tried to decipher a PDF from your bank? With Molecule, you can stop doing that.

Molecule connects directly to nearly 10 FCMs, and automatically downloads top-day and portfolio statements. Then it shows you how they match up with what's in your portfolio—making it ridiculously easy to identify problems, where and when they occur.